On an exchange you are typically limited to setting one order once the position is open, which can either be a stop loss order or take profit based on the difference between the prices. This lack of options is forcing you to pick: do you want to capture profits or protect your funds in case things go south?

Clever and responsible trading means having Stop Loss with every trade, but if you have to chose between placing SL order or TP on the exchange – most of the trades pick Take Profit in fear that they’d miss it and Stop Loss order would get filled in the meantime. Luckily, CLEO.one’s manual trading offers the ability to place two simultaneous orders that can manage your risk in crypto trading like a pro.

Lack of the ability to manage your trade well is very stressful. And it really does not have to be so complicated, manual trading is one of the many features provided by CLEO.one independently of crypto trading bots to simplify your trading automation.

Whereas there are some other third-party apps that offer similar functionality they still do not have the flexibility of using a Trailing Stop Loss and Take Profit. Check out special Binance plan that gives you access to the CLEO.one platform for free!

What is CLEO.one manual trading?

Manual trading lets you set a take profit and stop loss at the same time. It is for traders that do not want to run only crypto bots but want to be able to enter positions safely when the opportunity arises. Sell orders for both are created on CLEO.one are kept on the platform till the conditions are met. This way, both the stop loss and take profit can be customized and the price that gets triggered first is executed on the exchange. Using stop-loss and take-profit orders at the same time is very effective tactical tool to manage risks and increase profit.

How to profit from stop loss and take profit on Binance?

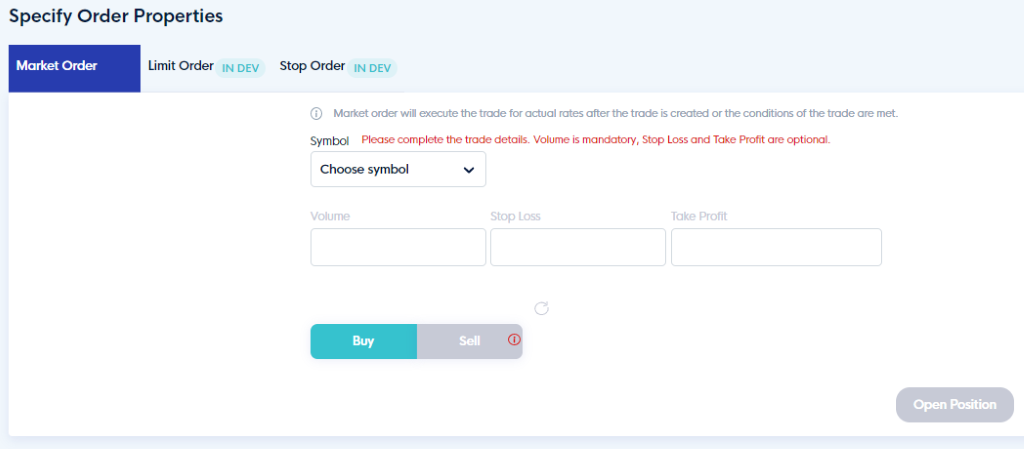

Since Binance does not support a simultaneous Take Profit, Stop Loss and Trailing options natively, you can set it up in CLEO.one. The process for opening a manual trade is quite straight forward. Once you created the account and added your exchange you need to press the “Open New Position” button in the right-side menu. You’ll be taken to the Market Order section:

Choose a currency pair you would like to trade:

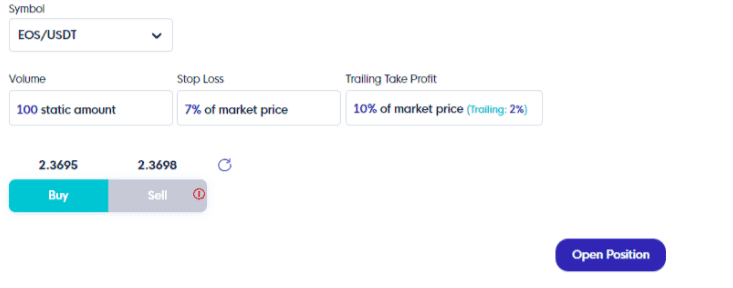

Fill in the Volume, Stop Loss and Take Profit fields to open the position.

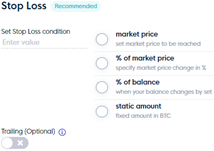

CLEO.one offers multiple options when it comes to defining the amounts you want to trade. If you wish to use Trailing option toggle “Trailing” on and then specify how much you want it to trail by. For crypto strategies and manual trades it must be a % of market price if you want to add a Trailing Stop Loss.

We then create the position as a market order, executed at actual rates with the simultaneous stop loss and take profit, including a trailing option. The position will close automatically once price is reached so you do not have monitor the trade.

CLEO.one offers limitless automation opportunities for Binance users starting from code-free strategies automation and testing to live strategy optimization. Manual trade or test and automate your strategies – the choice is yours. The best part about it – it’s FREE.