All traders ever dream of, is getting that edge over other traders. But what is “a trading edge” really about? A brand-new crypto bot, profitable trade signals, or maybe a newsletter from a trading influencer? The answer might be a bit less exciting, yet a lot more practical – it’s a positive expectancy of your trading strategy.

Whether you are an experienced trader or someone who still does not have a trading strategy to rely on, we can assure you that developing such system is a lot more doable than it sounds. If you’re only beginning your trading journey, we recommend you start by reading our strategy guide and subscribe to CLEO.one Twitter to get the best insights on intelligent crypto trading.

What is trade expectancy in crypto trading?

We’ve already mentioned a few things to consider when you’re developing a trading system, such as ways to measure returns, trading psychology, and drawdowns and risk. Whether you are developing your trading system or creating a crypto bot, the more tools you have for measuring your results, the better. Today we’re going to consider expectancy as a way to evaluate your trading system.

You might ask why use expectancy instead of simply looking at profits and returns? Well, there are a few benefits that come with it. Consider the following:

- Factoring out the effect of time

- Factoring out position sizing

- Factoring out effect of trading various instruments with different prices

So, when you are comparing multiple trading strategies against each other you can use expectancy as one of the benchmarks.

Most traders fall into the trap of only focusing on one of the aspects of expectancy often neglecting the rest. They only think of trading in terms of winning and hoping to achieve a success rate of 100%. While wining 80%-90% is possible, it is only one dimension of looking at it since winning isn’t the same as profiting. Number of trades you win or lose is not the only thing to consider, instead there are at least four aspects that expectancy addresses:

- Percentage of time you make money

- Relative size of profits and losses

- Cost of trading (execution costs, commissions)

- Actual trade opportunities

These aspects are the basis of expectancy, and they determine the effectiveness of your trading strategy. You can also think of expectancy as how much you are making from every position over time.

Expectancy, as defined by Tharp, indicated “how much you can expect to make on average (over a number of trades) per dollar risked” (137).

Calculating Trade Expectancy

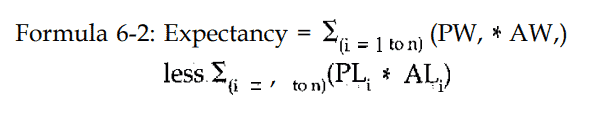

The formula for expectancy is based on the probability of winning and losing and is expressed in:

Expectancy = (PW * AW) – (PL * AL)

PW – probability of wining

PL – probability if a losing

AW – average gain (win)

AL – average loss

It is also additive and can be further transformed:

Trade expectancy can also be looked at in terms of R-multiples, where R stands for initial risk and Expectancy is the mean, or average.

Trade expectancy example

Ok this is all a bit much, let’s consider a real-life example of two different strategies:

- Strategy A wins 80 trades and loses 20 trades with an average gain of $50 and an average loss of $500

- Strategy B wins 20 trades and loses 80 trades with an average gain of $500 and an average loss of $50

In this case we’ll get:

- (0.8*$50) – (0.2*$500) = ($140)

- (0.2*$500) – (0.8*$50) = $60

Even though Strategy A had a winning rate of 80%, the losses were too big to generate any profit. Strategy A will generate an average loss of $140 per trade until it eventually drains the account. A classic trading mistake is to chase small profits and hope to win all the time. As you can see, it sets you at risk of letting losing trades get out of hand.

Strategy B on the other hand was losing 80% of trades but managed to stay profitable over time with a $60 average gain. A positive number is good when starting to investigate a trading strategy. It shows that the strategy is profitable.

How to take advantage of expectancy

In a nutshell examining your trade expectancy is a diagnostic for your strategies and their performance. It will force you to analyze what is going wrong and find out what can help you prevent it or minimize it. You can increase the number of winning trades, cut losses early, capture bigger wins and decrease the number of losses.

This is exactly how you can do it.

If we consider strategies A and B there are several ways, we can use expectancy to evaluate strategies and optimize them:

1.Increase the number of wining trades

This one is obvious yet with a low number of wining trades it is going to be hard to make any strategy profitable over a long period of time without drastically increasing the win rate. With a lower win rate, you would need larger gains to compensate for the losses.

2.Cut losses early

For Strategy A the first step would be to add some safety mechanisms to the trading system to protect your funds from being drained: adding a Stop Loss or trailing Take Profit.

3.Capture bigger wins

Analyze whether you can optimize your strategy for better-timed entries and exits to increase the gains. Bigger wins than losses are referable for a solid strategy.

4.Decrease the number of losses

Check if there are false signals that you can eliminate or if there is an indicator you can add to filter out the noise. We always mention these confirmation indicators in our backtesting experiments. With a higher win rate, you can afford slightly larger losses relative to the gain size.

Shortcut to calculating expectancy

In trading you don’t know the exact probability of winning or losing, but you can still backtest your system and evaluate results. You can do it manually, by investigating individual trades trying to understand the risk-to-reward ration of each trade and the possible frequency. It can be quite a demanding and time-consuming process if you have several ideas to test. That’s why so few crypto traders do it.

You can also go with CLEO.one’s backtesting tool and evaluate your strategy using several helpful metrics. Here is a quick demo of CLEO.one’s strategy creation and testing:

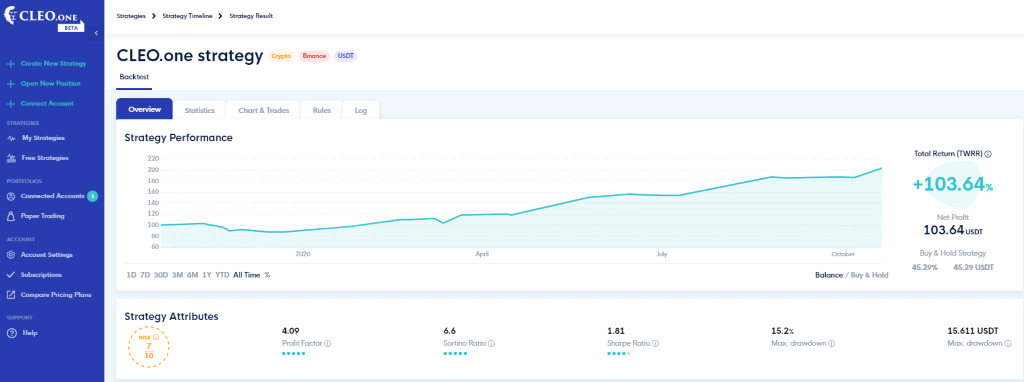

Once you have built your strategy, you’ll land on the strategy results page:

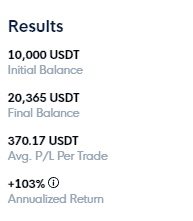

Our trading strategy in the example above seems solid in its backtesting results. The average P/L per trade will give us an indication on trade expectancy and can be found in the lower right corner, under Results:

Are you happy with your trade expectancy? Is there a way to improve the strategy and increase the average profit per trade? Keep on asking these questions and optimize your strategy further – that’s the kind of thinking that you might want to adapt to get the real trading edge.

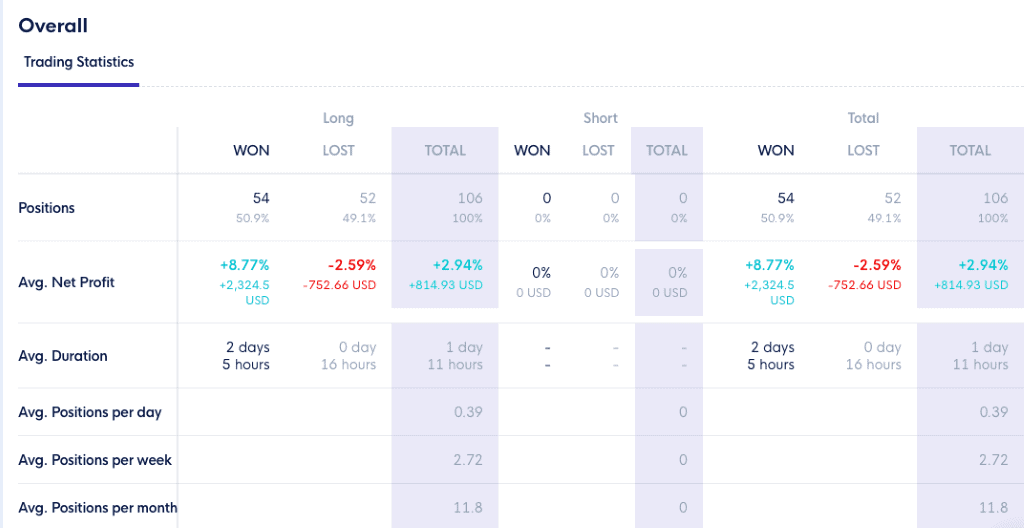

The next step would be to investigate the statistics under the tab with the same name:

Here we’re looking at trading strategy with potential. Over 50% of trades are profitable. Plus, the average profit is a lot higher than the average loss from losing trades, which eventually gives us a positive expectancy.

For any statistical significance we usually use a sample of at least 30 trades. 100 is way better and above 1000 it is very good. When you examine your trading try and gather at least 30 trades.

Just by looking at the strategy and evaluating the positions from the perspective of expectancy, we can start gaining confidence that according to the backtesting results we may be profitable in the long run.

CLEO.one allows you to create and test trading strategies by simple typing using more data than anywhere else. If you are serious about long-term profitability and beating the competition, this is the fastest and most intelligent platform to get you there.

To learn more about building automated trading systems for FREE check out CLEO.one special offers or schedule a call with our onboarding specialists and learn how to get that long-term profitability.

References:

Tharp, Van K. Trade Your Way To Financial Freedom. McGraw-Hill, 1999.