Humans are imperfect beings, and when money is factored into the equation making good decisions can be very hard. Our brains are wired with shortcuts. These shortcuts can help us make snap choices, as we make thousands of them every day. In trading they can be costly. They become biases that cause mistakes.

To be profitable in the long-term you need to know how you tick, and what kicks you off your course. Even if you plan there will be doubts. Let’s look at some biases that get a bit less attention than loss aversion or anchoring, making trading psychology harder to master. We offer solutions how to work through them. As every trader goes through them your edge may be in trading smarter.

1. Social proof in trading

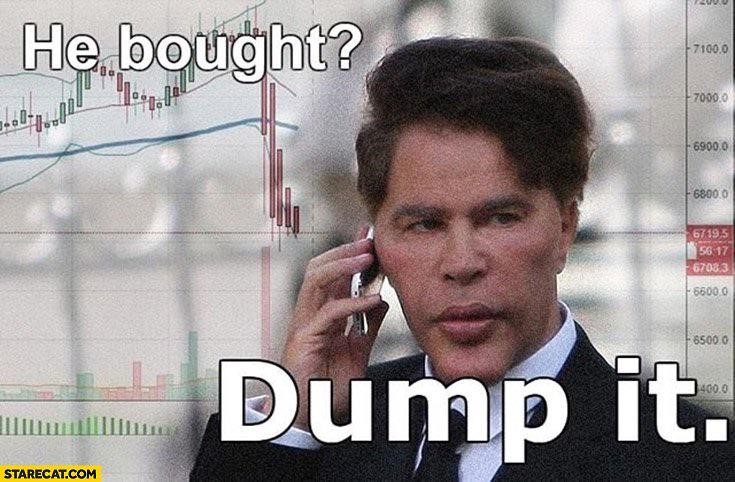

You’ve done your analysis and have your strategy. Feeling good and prepared, you open Twitter and a couple of people are expecting that price will do the opposite. “SCREENSHOT THIS TWEET!!!” included. Well if these “experts” are saying the opposite than it must be true? They are getting likes after all.

You start to doubt your strategy, hesitate on the execution and are effectively trading without a plan. Falling into exuberance your well-planned trading turns into scrolling through social media on what’s going to happen next.

What is happening: You’ve fallen victim to the social proof heuristic. Humans are social animals and when we see something cheered on by other people it becomes valid in our mind. That’s why we read reviews online and tend to flock to things that are already popular.

However, trading is an individual sport. You need to find your own path, usually in the form of a trading system, and be confident in your execution.

How to trade better:

Warren Buffet has famously lived in Omaha all his life, supposedly to escape the social proof offered every day in major financial centres. You don’t have to move, but like Buffet you need to create your own path.

Create a trading strategy and backtest it. You do not need to listen to anyone else when you’ve done the work. If the strategy works keep running it – that’s how you get confidence. Even if you make some mistakes on the way you’ll be improving and eventually reach independence. Pretty soon you’ll be able to laugh at your past behaviour and become a better trader.

2. Self-serving in trading

You’ve been trading for a while and have had a few great positions and a few bad ones. When it goes well you feel like a genius! You’re looking up cars, so you know which one to buy once the big gains come in, any moment now. Then you enter a position and price goes the other way. You curse your luck and blame Bogdanoff, or whoever is the villain in the narrative at the moment.

What is happening: The self-serving fallacy is making you believe that whenever you have good trading results it’s because of skill and whenever price moves against you it’s bad luck. This happens a lot in life: “Karen only got the promotion because she joined at the right time, while I worked really really hard for everything I’ve gotten in this company.”

It’s really fine if your brain is propping itself up and finds a way to feed you some self esteam. The point of these biases is that everyone suffers from them. It’s important not to let them hurt your trading.

How to trade better:

Like with most things in life it’s usually a collection of decisions that brings us to where we are. Taking responsibility for them, may not always be easy, but in trading, blaming the market or someone else doesn’t do you any good when you’re bleeding money. Truth: it’s literally the only way to success.

Accept that trading is about winning AND losing positions. There’s no way around that. Do the work beforehand. Understand through backtesting roughly what you can expect and then push through it. Trading strategies need to be executed consistently to be actually yielding results. If you’re well prepared before executing your trading, luck will magically start being kinder to you.

3. Mental accounting in trading

Maybe things have been going well for you and your strategy has started to yield consistent profits. You’re looking at what to do with those profits and decide to put most of them in a promising, but young tiny DeFi project. You would never risk your salary like that, but this is different – these are your profits. You are so cautious with the rest of your funds! You’ve been risk managing like a professional for months. You deserve to let go a bit and have a shot at a x100 or x1000 maybe.

But then you experience a rug pull and the tiny project is down 70%. You’re looking at your trading stack that’s growing consistently and imagine how much more it would have been if you’ve been wiser with your profits.

What is happening: Mental accounting got the best of you. Your brain processed the profits as separate money than your initial investment that came out from your pay check. However, your only job as a trader was to not lose net worth but increase it.

This happens to people all the time. They will spend a bonus more recklessly than their regular pay, or buy something they cannot afford with leftover money from a different purchase. It’s just may be more painful for traders that are usually cautious with their funds.

How to trade better:

All your funds are equally valuable, no matter where they came from. Of course, you should pay yourself for the effort and enjoy yourself if things are going well. Consider which profits you will add to your trading stack, how much will you spend on whatever makes you happy, and how much you can reinvest. This will depend on your life situation and other expenses as well.

Be aware, there are no magic money just because of their origin. You need to watch your net worth.

How to account for most biases in trading:

Knowing how your mind works is the first step in mastering your emotions. You’re aware if your strategy is well researched or you are just trading randomly. Making true progress depends on you grappling with your impulses. It does not matter if you are trading manually or through crypto bots. Trading is not about short term lucky wins, it’s about consistent profitability.

For the best trading tool that will help you manage trading psychology with testing, automation, paper trading, and powerful risk management check out CLEO.one.

When you connect a Binance exchange account you can use CLEO.one for free! The account is packed with live trading bots, backtests, paper trading slots, and more. Sign up today and secure your spot.