One of the most prominent crypto trends of 2020, replacing ICOs of 2017, are DeFi projects. It seems the buzz around them is here to stay. The main idea behind DeFi are decentralized applications for saving, borrowing, lending, and funds custody without any intermediaries. Today we’re going to look at one of the movers of DeFi and definitely the most emerging exchange of 2020 – Uniswap, an automated market maker (AMM) liquidity protocol.

What is Uniswap?

For an exchange to happen you need to have buyers, sellers and liquidity. Uniswap removes the middleman by facilitating the exchange of ERC-20 tokens without a traditional order book system. It is technically a decentralized exchange (DEX). Using smart contract technology, it creates liquidity pools and facilitates swapping against the reserve. Anyone can exchange tokens, add them to the pool in exchange for commission, remove them or even create a new trading pair.

Uniswap has a rather different pricing mechanism, compared to other DEXs called the “Constant Product Market Maker Model.” When you buy and sell you only need to select the token, the exchange provides a market rate and thus liquidity can be provided, even if the price for a selected token rises.

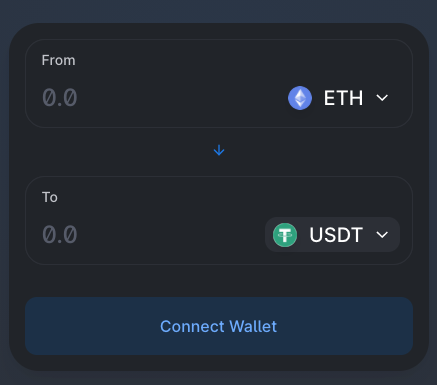

Swapping tokens on Uniswap provides you to have full custody of your funds and, therefore, requires plugging in a wallet and you’re in. No log-ins or KYC. You’ll need to select tokens to swap, initially unlocking them. Keep the gas fees in mind, you need to pay them for each transaction. Etherscan or Ethgasstation can give you a good estimate for the gas prices at the moment, so it might be a good idea to check it beforehand.

How to earn interest on Uniswap?

With Uniswap you can also earn interest by providing liquidity. Unlike central exchanges, Uniswap is a public tool that doesn’t incentivizes liquidity providers for locking up their tokens to allow others to trade in a decentralized system. You have three main commands on the exchange: Swap, Send, and Pool. ‘Swap’ is for trading, ‘Send’ option is similar to withdrawing funds while the ‘Pool’ option allows you to become a liquidity provider.

Since Uniswap is a public pool, anyone can become a liquidity provider and earn commission for a selected token pair by simply depositing token to the token pools.

In order to become a liquidity provider, you need to follow the instructions on the ‘Pool’section of the exchange. There you can select between ‘Adding Liquidity’ and ‘Creating a Pair’, input the amount you’d like to deposit and click the button to add liquidity. Once the amount is successfully deposited you will get a proportional amount of pool tokens.

If you actually decide to earn interest on Uniswap you might want to track your returns and that’s when UniswapROI comes in handy. You can check it regularly to check your earnings, but also keep in mind that whatever cryptocurrency you’re holding in Uniswap, it is subject to price fluctuations and can aslo appreciate or depreciate over time.

How did Uniswap start?

The creator of the protocol Hayden Adams started off Uniswap as a small project to practice his Solidity skills. Eventually he secured a $100K grant from the Ethereum Foundation and became one of the most crucial components of the DeFi ecosystem.

Since its first V1 launch in 2018, Uniswap made it to the top 10 highest-valued DeFi projects and claiming to lock $1billion in liquidity in late August:

As Hayden shares on Uniswap’s blog, Uniswap was inspired by Vitalik’s idea on building decentralized exchange based on automatic money makers.

The story doesn’t simply stop with Uniswap alone. Following the success of this decentralized exchange, we’ve witnessed the breakout of its fork, known as SushiSwap. It took over 77% of Uniswap’s traffic on September 1st, and garnered more than $1.5 billion in its first week. While it has earned a lot of attention, the liquidation of $14 million worth of Sushi tokens by one of it’s founders caused a lot of skepticism towards the contender and unintentionally made Uniswap even stronger.

There are at least three good reasons for the success of Uniswap:

- It allows full custody of your funds through a friendly UI

- Lack of KYC or other verifications

- Access to newest and hottest coins before they get to centralized exchanges.

This all sounds attractive, but as it often happens in crypto – it comes at a cost of being extra cautious with your transactions. They may fail and existence fake coins do exist. Uniswap is still in its early stages and thus can be very rewarding, while the costs can get high too.

What is more important is that the whole existence of projects like Uniswap raises a more important question in crypto, it is a question about control: do we need traditional exchanges with their commissions and funds custody to exchange tokens for us for a piece of mind or decentralization is the way to move ahead?

Can I trade Uniswap projects on centralized exchanges?

If you don’t feel totally confident about the idea of Uniswap liquidity pools and it just doesn’t sound right for you, the good news is that it’s not necessary to use it to benefit from it. If you are curious about a project just wait for the token to be listed on a centralized exchange, where your funds are more protected. You can use Uniswap as a temperature check for potential projects and anticipate big moves.

In case you’d like to give it a go, approach it as trading on any exchange with the added layer of navigating a DEX:

- Establish your trading strategy (backtested strategy that has potential). See this guide on how to start creating a solid trading strategy.

- Forward test it on live or paper trading. You don’t have to do it manually, just set a crypto bot to run it in minutes. This will give you the needed confidence.

- Calculate gas fees and make sure you have those extra funds ready.

- Execute the strategy consistently.

- Reevaluate after you have a decent sample size of trades – at least a month.

This approach does prevent you from making rash decisions. It’s not in line with the All-gas-no-breaks attitude that seems to envelop Uniswap. If you’re after getting lucky once it might not be for you.

Yet if you want to be a long-term profitable trader with a shot at financial independence, your advantage lies in being strategic.

For the best trading tool that will help you manage trading psychology with testing, automation, paper trading, and powerful risk management check out CLEO.one.

When you connect a Binance exchange account you can use CLEO.one for free! The account is packed with live trading bots, backtests, paper trading slots, and more. Sign up today and secure your spot.