The internet is not short on trading resources. For those that want to be more informed, it’s more about going through a lot of noise before they can get to the gold.

If you are wondering who to listen to, read, or follow next on trading we give you our favorites. This installment starts with books. Some are about trading in general others are biographies, plus we picked our Forex favorites for this occasion.

Some traders swear by reading many of these, others find one is enough. We love being immersed in different trading perspectives and find we always learn something new that helps with trading system development. Below we are outlining a long list of trading books that is worth your time:

Books on trading in general

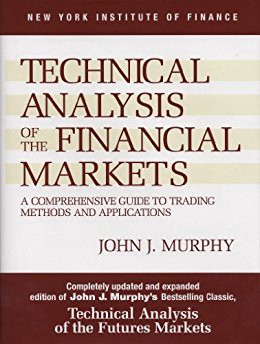

Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications — John J Murphy

Written by the founder of inter-trade technical analysis, this book truly is comprehensive and to the point. It reads like a textbook and lays a solid foundation to the technical aspect of trading. Great for those who are starting to trade and intermediate traders.

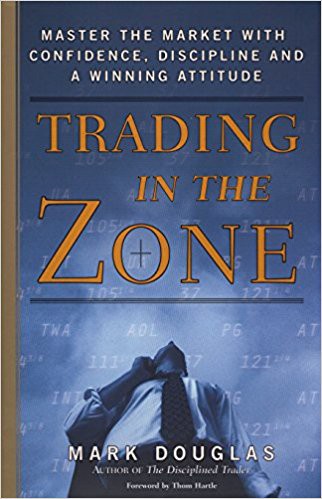

If any book on this list can be described as “meta” it is Trading in the Zone. An easy read that has stood the test of time, as it unravels the universal truths about trading and the warranted psychology that every trader should strive to adopt.

Al Brooks has chosen a boundless topic to cover in Trading Price Action Trends, and goes through how to trade trends, trading ranges, breakouts, and reversals, while also covering candles, determining trend channels and more. It’s a demanding and immersive read for those that want to deep dive into the topic.

Secrets for Profiting in Bull and Bear Markets — Stan Weinstein

Weinstein provides advice that can be applied very universally, although some of the examples may sound outdated. He explains market cycles (a crucial and often overlooked aspect of trading) and appropriate methods of approaching the market for each type. He also primes traders for the necessary mindset to prevail.

A Complete Guide to Volume Price Analysis: Read the Book Then Read the Market — Anna Coulling

Attempting to break through the jargon and provide a concise view of markets and main actors, Coulling’s book does a great job at helping traders with timing and persistence. The described principles can be applied to most markets.

Forex specific books

Seen as a great foundation and read by many, Nekritin urges traders to take a step back from indicators and respect the power of price. It is a nice collection of basics translated into practicality and can continuously serve as a reference book.

Day Trading and Swing Trading the Currency Market: Technical and Fundamental Strategies to Profit from Market Moves — Kathy Lien

This comprehensive book brings fundamental analysis to the forefront and provides a much-needed explanation on what causes moves in the currencies market. It does touch upon technical strategies as well, but its strength lies in giving traders a road map on how to navigate news.

If you are just entering the market and thinking this will be an easy journey, start with this book. It pulls the curtains on the machine behind the Forex markets and some of the realities that, particularly retail traders, must navigate on their path to profit. It is bordering on an intermediate read, although any trader should know what brokers or dealers do and what strategies they can implement to perk up their odds when trading.

Traders’ biographies

Reminiscences of a Stock Operator — Edwin Lefèvre & Roger Lowenstein

One of the most revered trading books of all time, it follows trading legend Jesse Livermore through the rollercoaster of his career. The insights are simply timeless and any trader of any level will find themselves in some part of the story. By the end we are witnessing a complete disbalance between Livermore’s personal and professional life, that he each led in an opposing manner.

Market Wizards — Jack D. Schwager

This book and the subsequent New Market Wizzards are a set of interviews with successful traders. Their professional development, journeys to productive mental attitudes, and the trials of their trading systems are all at your disposal to learn from. It’s as timely now as when it was first written.

In the next post we will cover blogs, podcasts and Youtube channels.

Did we miss some of your favorites here? Let us know — we would love to check out your recommendations.

See how to be serious about your trading by treating it as a business

CLEO.one is a technology provider that wants to help traders develop their own trading strategies in the easiest and quickest way possible. Try our CLEO.one crypto bot creation: create, test and automate simple or sophisticated strategies with unmatched flexibility!

CLEO.one is set making independent trading simpler and easier by providing the most powerful and comprehensive trading tools on the web — we would love your feedback so get in touch at support@cleo.one or follow us on:

Twitter, Facebook, LinkedIn, Youtube

Try it for yourself! Click here and create your own trading strategy.

There is no quicker or more powerful way to build and backtest a trading system.