In a draining 24/7 crypto market where the next big move can happen at any time (always when you are sleeping somehow), you may have considered crypto bots as an option. Crypto bots for Binance or other exchanges have grown up.

No question why crypto markets are specifically attractive when it comes to trading automation, but not all automation is created equal. Creating a profitable crypto bot used to require some serious effort, but things have changed. So if you are wondering how to build one for yourself, while only spending a fraction of time you might want to keep reading till the end.

Crypto bots today

The biggest mistake you can make when entering crypto trading in general, and automation in particular, is having that get-rich-fast mentality. Profitability comes with time and effort spent on perfecting trading strategies. The best advice for novice traders out there is to stay focused on long-term results.

Crypto bots can still be hard to use

If you’re not new to crypto bots, you might have already faced certain challenges. Just to name a few:

Trading the wrong strategy

In such a volatile space like cryptocurrency your strategy is effective till it isn’t so developing safety mechanisms is key. Part of the learning experience that comes from developing and trading the algorithm is that ability to adapt to the everchanging environment. Backtesting is a great way to mitigate this.

This is a good starting point on creating a great crypto trading strategy.

Learning programming for months

To create a bot that gives you the flexibility of including the parameters you want, risk profile and backtesting, you used to need to code and collect data. Before you even start trading you needed to learn how to understand programming, on top of trading, of course. If you don’t feel like learning how to code nor have the confidence to develop, there are platforms out there that sell already programmed bots, but not without the risk.

Shady crypto bots and signals

Most who enter the crypto space get tempted to sign up for another signal channel or buy out-of-the-box bots that promise triple-digit returns. A lot of these pre-programmed bots, however, don’t share the trading algorithms behind it. It can be quite risky to invest in a crypto bot without even knowing what kind of strategy it’s based on. Of course, experienced traders know that the only way to get those promised returns is through understanding of the markets.

Failing to develop as a trader

Even the most reliable bots cannot give you the skills and experience of learning and experience. What certain bots can do, is help you to get that understanding faster. Much faster.

Facing pitfalls on your track to profitability can be discouraging but it should not be a reason to scrape the idea of using the bot completely. Going through the path of developing, testing, and automating your trading ideas will eventually pay off, you just need the right set of tools to get there.

The best way to create a crypto trading bot for Binance

With CLEO.one you can create, test and trade using your own trading algorithms (or use on of our free ones) without programming or coding. Your bot can be used for Bitcoin, Ethereum and all other coins available on the crypto exchange. It consists of entry and exit conditions, as well as Take Profit and Stop Loss – trailing or regular.

- To start trading with CLEO.one, first, you need to sign up – it is completely free and takes minutes.

- Instead of programming you can input your ideas in simple typing using indicators, price action, candlestick patterns, crypto fundamentals, etc.

You can also browse our library of strategy examples to get your brain juices flowing. You can find strategies with the most popular indicators such as Bollinger Bands®, RSI, MACD, Candlestick patterns, crypto fundamentals, price action, and more. Read till the end as we will dive in different strategy types.

- Backtest your strategy with a single button click. With our Binance Free account you can run up to 100 (!) backtests per month for $0.

- Automate your winners and launch your crypto bots #ToTheMoon, also for $0.

Trading strategies for Binance crypto bots

Let look at different types of strategies you can use to build your bot:

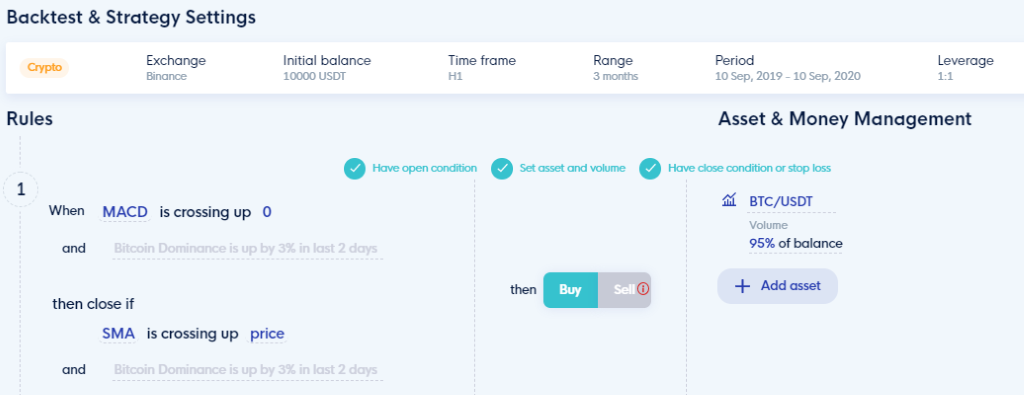

Strategy based on technical Indicators

One of the most popular indicators known is MACD. Let’s consider a basic MACD strategy, in combination with SMA, that improves strategy performance:

When MACD (12, 26, 9) is crossing up 0

Then BUY BTC/USDT

Volume: 95% of balance

Then close if SMA (9) is crossing up Price

Time frame: 1 hour

When used in a platform the strategy will look as this:

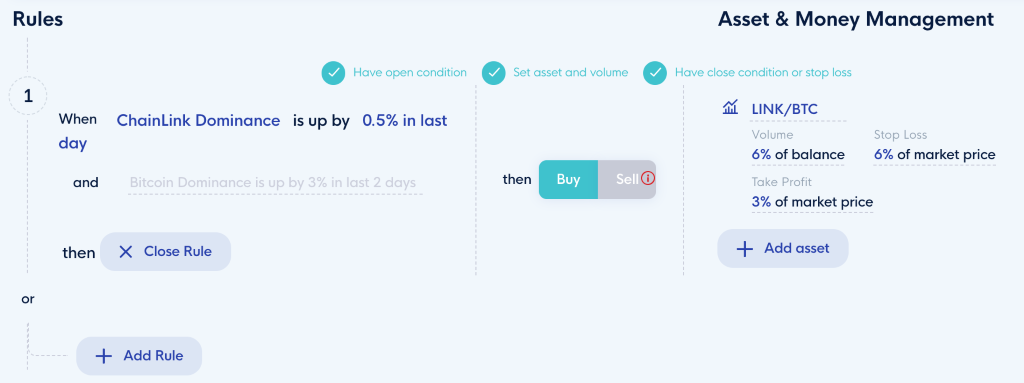

Strategy based on Crypto Fundamentals

Dominance, Market cap and Volume can be used alone or in combination with each other for identifying both exits and entries.

The rules:

When ChainLinkDominance is up by 1% in last day

Then BUY LINK/BTC

Volume: 60% of balance,

Stop Loss: 6% of market price,

Take Profit: 3% of market price

Time Frame: 4 hours

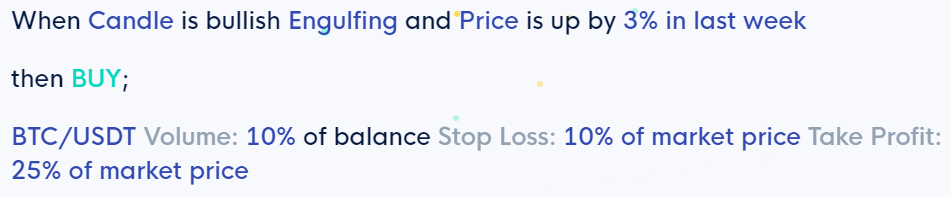

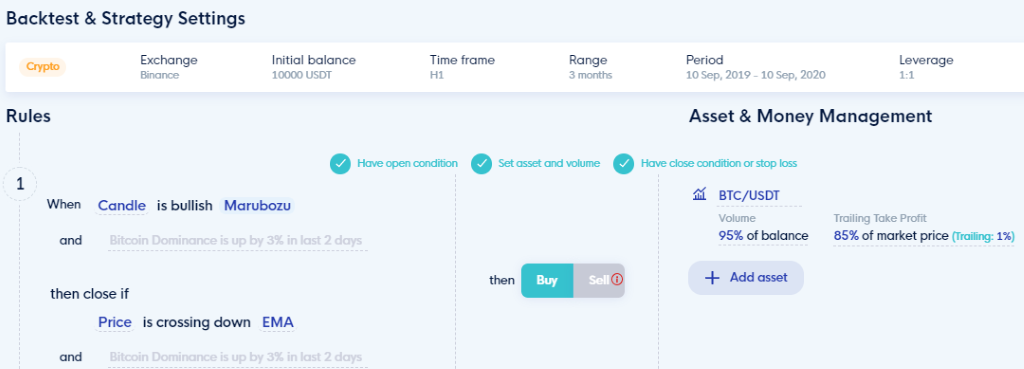

Strategy based on Candlestick patterns

Candlestick trading strategies are based on timing positions using candle structures. They are great when it comes to determining the market situation in crypto trading. Also, adding additional indicators may increase the performance of the strategy based on candlestick patterns.

The rules:

When Candle is bullish Marubozu

Then BUY BTC/USD

Volume: 95% of balance,

Stop Loss: 6% of market price,

Trailing Take Profit: 8% of market price (Trailing:1% of market price)

Then close if Price is crossing down EMA (20)

If you need further inspiration go check out our collection of trading strategies with full backtesting results and optimization ideas. Or this in-depth guide on creating strategies.

With CLEO.one the crypto bot creation process itself takes minutes, as long as you have trading ideas to test. You will also find plenty of opportunities to backtest, paper-trade or run crypto bots for free. That way you can develop them further and develop yourself as a trader.

The best part is that with the latest Binance promotion you can sign up and start setting your CLEO.one bot for FREE! All it takes is an eligible Binance account. Find out more here and start running crypto bots on Binance with CLEO.one now.