Crypto trading strategies are still not widely discussed in the trading space. The reason might be that it is still young, with many traders getting lucky rather than good. When we say “good” we mean consistent, focused on long-term profitability with a chance of financial independence.

If you are interested in making money of crypto for longer than a few lucky breaks, backtesting should be a tool you are cosy with. There is hardly a profession today that does not rely on data and historic research to devise a strategy. Backtesting crypto strategies has become so easy, that this blind spot for the rest can be your edge.

Here are 5 reasons you should be backtesting your crypto trading strategies:

1. It forces you to think in terms of trading strategies

Sure, you can go all in on some small cap crypto project with your life savings in the hopes of x100. But you know what’s better? A trading strategy that can bring consistent profits over longer periods of time! Don’t join the ranks of the crypto-ruined-my-life-brigade.

Preparing may not sound exciting, but when the market does not go your way (and it will surprise you) you will be thrilled to be left out of the excitement.

Creating a crypto trading strategy is easier than you think. Play with basic concepts and soon you will have something to protect you from future crypto winters.

2. It shows you if your trading approach is worth it

You may be trading a certain way for some time now and it might be yielding you some gains. But what about a longer period? Or in a bear/bull/ranging market? Are you on a winning streak that might go south at any moment? How many trades can you expect? What win rate? Are you maximising your profits or cutting your winners too soon?

That is a lot of questions…if only there was something you could do in minutes to answer them…

All technical, sentiment, and fundamental analysis is done on historical data. Backtesting may not predict the future but it is your best bet in knowing what to expect.

Do you want to find out that you are trading a dud by running a backtest for a few minutes, or by losing your trading funds?

3. It gives you confidence in your trading

Many traders struggle with confidence. With so many people posting their analysis that might contradict yours, having doubt is normal.

After all we are arguing about predicting the future.

Backtesting your crypto trading strategy means you have math on your side. Even if you enter a losing streak you know that a turnaround is around the corner according to your test results. If the market turns and goes from an uptrend to a downtrend you have a plan.

Confidence comes from being prepared. Backtesting is that preparation.

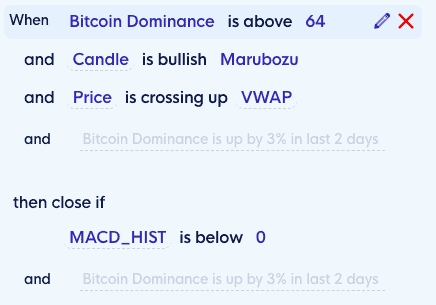

4. It makes you try new things

You may be looking into a candlestick strategy for Bitcoin. You notice that you hold your losing positions for too long. You start looking into things you have not used before. OBV for volume, maybe implementing Bitcoin dominance to keep track of market cycles between alts and Bitcoin. You try the same strategy on LINK and see it works even better.

Some approaches work, some don’t. That’s totally fine. The beauty of backtesting is gaining trading experience without spending funds or waiting for time to pass.

The toolkit you build along the way allows you to make better decisions and know what to employ and when.

5. It teaches you risk management

Traders get so tangled up about risk management, how to measure it, and what is the best strategy. The main, very general principles are simple: decide on amounts for different scenarios, never go all-in, and execute it consistently.

Yet how do you decide on your principles is not always clear. Instead of risking funds for trial and error, you can do the same through backtesting. Set different trade amounts and check if trailing stop losses and take profit are hurting or helping your performance. You might be surprised.

Consider how you allocate amounts: % of your balance, a fixed amount in the cryptocurrency you are trading or in BTC/USDT. There are flexible ways to think about position sizes that can really help you when actively trading.

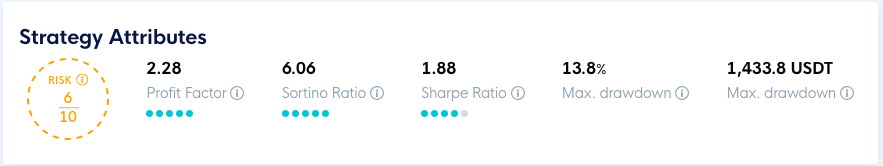

Lastly a good backtester should give you major risk evaluations like Sharpe, Sortino ratio, and max drawdown out of the box. This used to be something you needed to calculate but today you can get it with a single click. These can be a major factor when evaluating your trading approach.

Key takeout:

Backtesting your crypto trading strategies will make you a better trader through experimentation, learning risk management and evaluating your approach. Ultimately it makes you think in trading strategies and gives you confidence. You need all of it for long-term profitability.

Yet backtesting is not the final answer, but a means to an end. The ultimate goal for any professional algorithmic trader should be creating portfolio of strategies, that are able to trade multiple assets during multiple market scenarios. Some strategies are more aggressive, while some are solely focused on capital preservation during downturns.

Backtesting is the tool, where this journey starts. It should be approached more like MVP (minimal viable product) for your strategy – it is the first step, not the only step for long term success in trading.

If you are looking for the best backtester in crypto with:

- No programming set up of trading strategies– only typing

- Out-of-the-box historical data from multiple exchanges like Binance, Coinbase Pro and others Loaded with indicators, price action, candlestick patterns, crypto fundamentals and more

- Automatic risk calculations

- Run your best strategies as crypto bots

- Free

Check out CLEO.one. Simply create an account and start backtesting for free.

When you link your Binance account you get even more backtests and you can run your best strategies as crypto bots for free. Sign up now!