Ever wondered how having multiple options when choosing the size of your position would impact your strategy performance? Good news – it’s already a part of CLEO.one’s strategy builder and manual trading. Ready to give you elasticity in how you place positions and the ability to move quickly. After enjoying such flexibility, you might want to stick with us for more exciting features like Limit and Stop orders, which will be equally as flexible.

Position sizes in crypto trading for the past decade

If you trade exclusively on an exchange you are probably familiar with the standard way of placing an order. It all basically comes down to selecting position size based on the price and amount. Every time before opening a position the trader needs to consider how much they are willing to risk and calculate it accordingly. It adds an extra step that needs to be done every time before entering a trade.

However, this does not reflect an active portfolio. Balances change and if you are running a crypto bot or placing manual trades you need it to reflect those changes. You want to be able to express amounts as percentages of your overall balance, the cryptocurrency you are buying (500 ADA) or the currency in which you are trading (200 USDT). That would help you be mindful of risk management without having to spend a ton of time converting currencies.

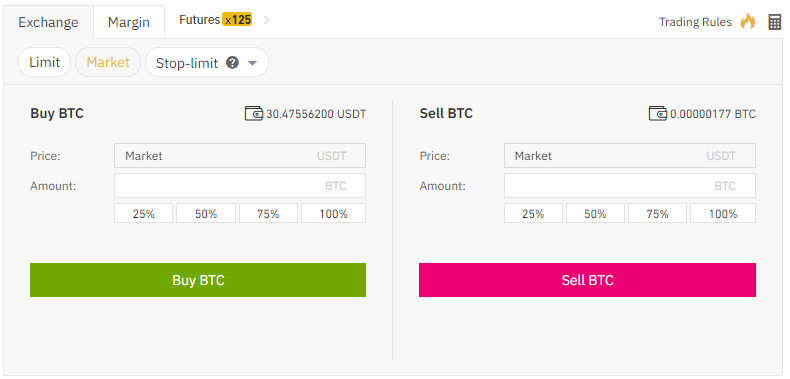

Here is how Market orders look on Binance:

Challenging this set up is uncommon as it’s so engrained to many exchanges. The lack of a simultaneous Take Profit and Stop Loss complicates things further. The thought of setting positions sizes differently may seem foreign to crypto traders still, while it is widely used in traditional markets. So independent traders have gotten used to the rigidity of how exchanges work, but it doesn’t reflect the complexity of entering and exiting positions, especially when you think in terms of automating your trading strategy as a crypto bot.

Position sizes that allowing quick decision making

Trading requires quick decisions. The smallest delay can be expensive. You don’t want to waste valuable time doing unnecessary conversions. Going beyond how position sizes are usually placed, we decided to give you all the control that you need:

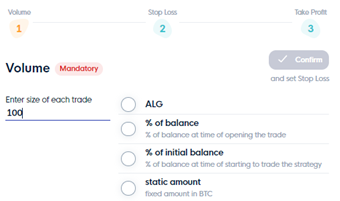

You have a choice of multiple ways to enter position size:

- ALG – placeholder for any currency you are buying – position size is defined depending on the selected currency (Ex: ALG/BTC) – buy 10 ALG

- % of balance – position size is defined as a percentage of balance at the time of opening each trade. As your balance changes so do your position sizes – 10% of my current balance

- % of initial balance – position size is defined as a percentage of the balance when you started running the crypto bot – 10% of my balance when I started trading the bot

- Static amount – position size is set based on a static amount in the base currency in which you are trading – 20 USDT or 0.5 ETH worth of ALG

If you do not have these options you would need to be converting, checking in, calculating, and spending much more time preparing your positions or crypto bots. Not to mention, if an epic trade opportunity rises and you want to set a quick manual position quickly without wasting time. Being able to set position sizes in the best way for you will save minutes and minutes make all the difference in trading.

We live in a time where customization makes good products unique. CLEO.one is aiming to equip professional and aspiring traders with the tools for profitable trading that go beyond what has already been done.

Sign up now and beat the competition with the best tools on the market! Free to use with Binance.