Trading signals are an easy way to monitor the markets without monitoring the markets. Instead of following someone else’s – create your own. Become a better trader while enjoying life and never miss a move on as many trading pairs as you want to follow.

The appeal of trading signals

Trading based on signals you get from a “certified profitable trader” looks like an easy way to earn money. No responsibility, nothing to monitor – just potential profits.

There are numerous apps, email lists, Telegram groups, WhatsApp groups, Discord servers and sites that claim their win rate is 85%! That claim is a stretch to say the least.

Two traders can be trading the same strategy. Yet one may end the day in the green and the other in the red.

You could get lucky a few times and make a few pips or satoshis. Still in terms of you profiting long term or developing as a trader you would be standing still.

Basing your trading on signals is a bad idea for a few reasons:

1. You never learn anything about trading

Your trades are blindly executed. No time spent with the charts, no backtesting, no money management. Your confidence stays low. You never improve your trading.

The lack of transparency of what strategy you are trading makes it impossible to optimize. Your trading psychology remains that of a novice.

2. It might be a scam

It’s easier to sell fake signals than to become a great, profitable trader so people do it.

Even Investopedia mentions signals among the most frequent types of trading scams. The internet is not short on personal examples.

3. The signals might come late

Small market caps that are easy to manipulate are plenty in crypto particularly. You might be used in a pump and dump scheme by a group or individual or just for the personal profit of the signal sender.

They usually stack up on some cheap altcoin. Then send “the signal” in waves to smaller groups within the same signal group. The value of the altcoin gradually starts going up. By the time you buy in, it starts to go down.

In the end while the signal provider sells their holdings at the top. You end up with bags of a tanking asset.

But wait I have a job and a life, am I supposed to stare at charts all day?

We get it, the image of a lonely trader with 4 screens around them may not be a feasible pastime for you. You still want to track market conditions on multiple pairs. You still want to profit from big moves. Every Golden Cross, MACD crossover or Price move above the SMA(50) should be on your radar. Plus, their combinations and combinations with different indicators or fundamentals.

Good news! There is a better way to get your own trading signals!

Imagine, you set your conditions and get an alert. Yes, price alerts are old news. But knowing that BTC dominance is down by 2% in the last day and a bullish engulfing just appeared on the ETH weekly charts?

Or you’re waiting on a MACD crossover, a bullish doji and price over the 50 SMA. Be in the know whenever this is happening on ANY and EVERY pair you’re interested without staring at the charts.

Running paper traded strategies on CLEO.one and opting for notifications is one of the easiest, most powerful and flexible ways to generate trading signals.

Trading signals from Paper Trading

What you can expect from paper trading on CLEO.one

- Test your strategies on live market conditions without risking any funds

- Own signals straight from the market

- Forget about coding all is done through simple typing

- Backtesting for crypto, forex and equities included

Among our featured strategies you can find a wide range of fundamental and technical indicators. Feel free to use our free strategies on your paper trading account:

- Free Paper Trading Strategy Combination of VWAP, RSI, Candlestick patterns (BTC/USDT)

- VWAP crossing Using purely Volume Weighted Average Price (LINK/BTC)

- Simple EMA Using purely Exponential Moving Average (ETH/USDT)

You can find more information about our free strategies and what you can do with them.

In case you prefer to create your own strategies, for instance RSI or the Golden Cross, it’s also a piece of cake.

How to set up your own signals on CLEO.one paper trading

You must first set the strategy to paper trade. The same strategy can paper trade on as many pairs that you would like so you know that key conditions have been met wherever you are. Then you can opt for notifications whenever a position is opened or closed or a liquidation happens.

How to set notifications:

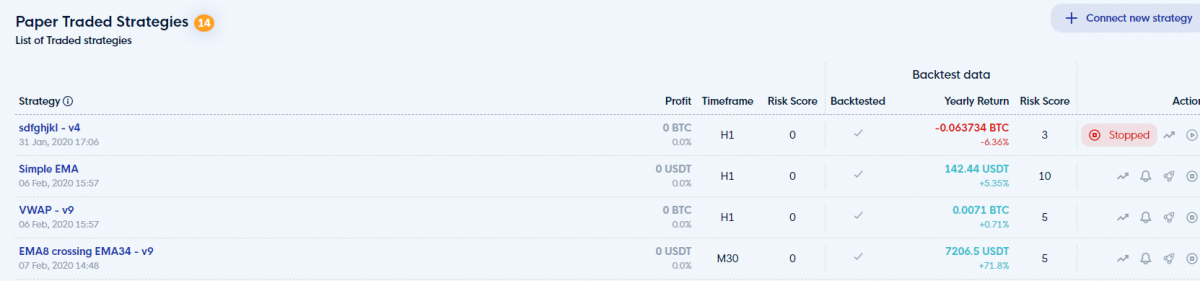

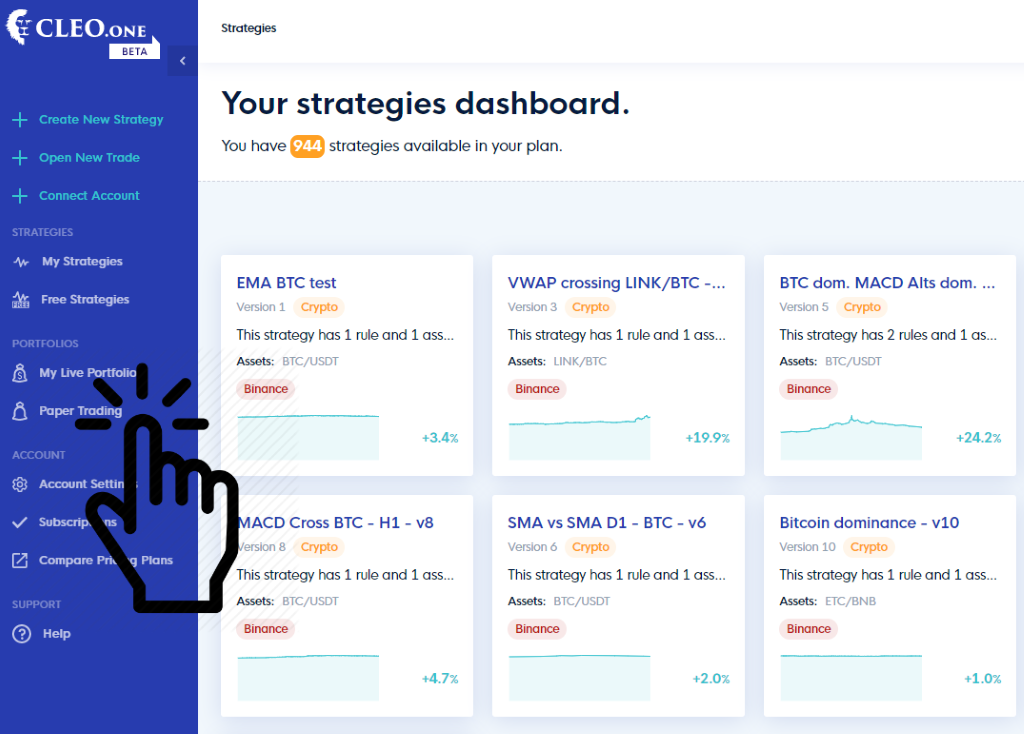

- Click ’Paper Trading’ on the left-hand side

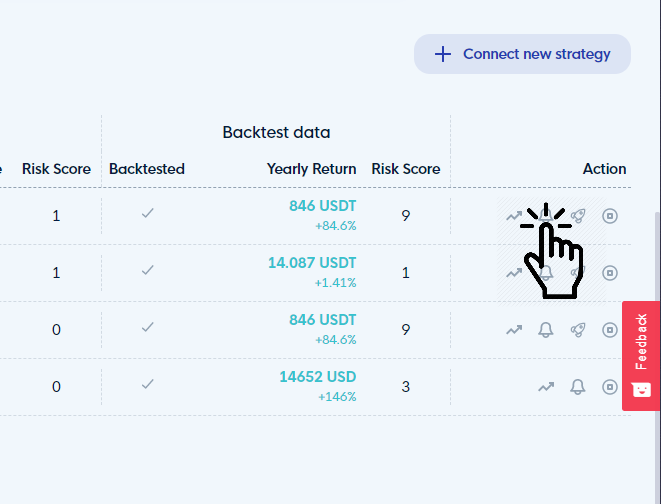

2. Scroll down to your strategies and change the one you like

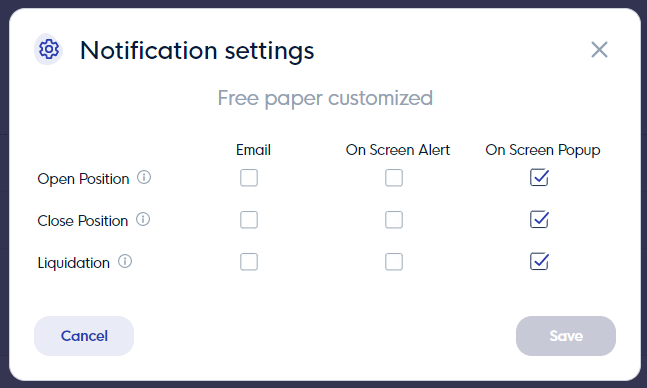

3. Click the bell icon on the right-hand side and tick the required notifications

4. Tick the boxes for the notification you would like to get (email recommended) on the pop-up window and click ‘Save’

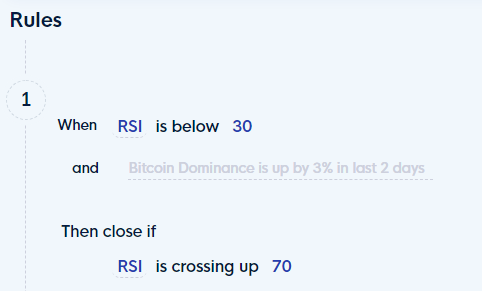

Example: Setting up overbought/oversold levels with RSI

RSI indicates overbought and oversold events, used to spot trend reversals and thus entry or exit points for your position. The asset is considered overbought when RSI is above 70 and oversold when it is below 30. This can be specified easily as so:

To customize, simply click on the name of the indicator, and you’ll be able to change the settings in a pop-up window.

You can of course mix and match this with BTC dominance, MACD or any other technical indicator or candlestick pattern.

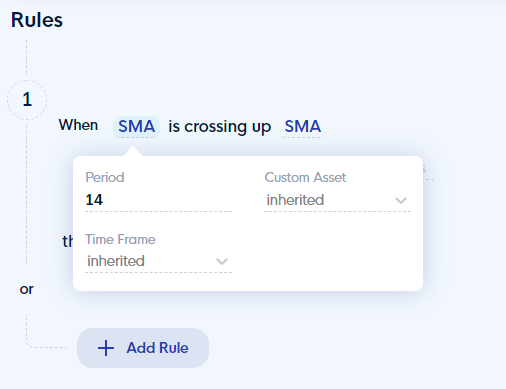

Example: Setting up a Golden Cross

You can easily set up the popular ‘Golden Cross’ signaling system. All you need to do, is to type the below condition, click ‘SMA’ and tailor it to your needs. Setting the first one to 15, the second one to 50 is a commonly used strategy. Try different values, run a test, and see, if you can achieve better results.

See all the different types of strategies that you can set in CLEO.one. You can backtest or run straight on the exchange!

1 comment

Great content! Super high-quality! Keep it up! 🙂