Reasons why to use crypto bots.

Testing trading strategies and deploying live crypto bots can be done in under 10 minutes.

The beauty of the CLEO.one platform is its flexibility that provides infinite possibilities when creating your crypto trading strategies in minutes. We’ll provide some inspiration into what you can do.

How your trading ideas can be inserted into CLEO.one – the basic syntax of a trading rule

When you start typing you will get many options on how to finish the rule. Just because there are many options, it does not mean that the input is complicated. The basic syntax can be broken into 3 parts:

When [THE INDICATOR/TRADING PAIR] is [ABOVE/BELOW/CROSSING DOWN/CROSSING UP/DOWN BY/UP BY] [VALUE/INDICATOR/TRADING PAIR]

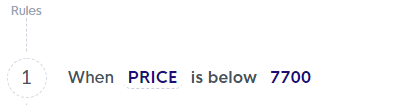

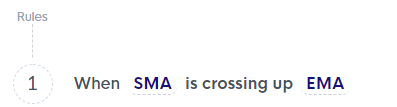

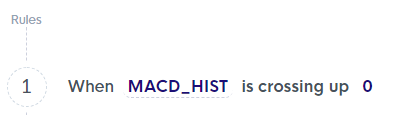

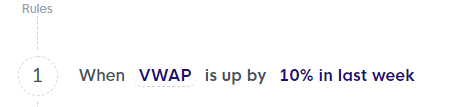

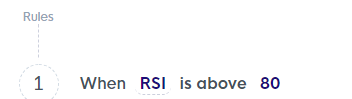

A few examples straight from the platform:

Setting a rule that will be triggered when the price of a trading pair, in this case BTC/USDT is below/above a certain threshold

Any Moving Average crossing up/down the same, or another Moving Average

MACD histogram turning green indicating a bullish reversal

An increase in Volume Weighted Average Price

Use the price movement of any pair to trade the same or a different pair

Identify oversold/overbought levels with RSI or Stochastic

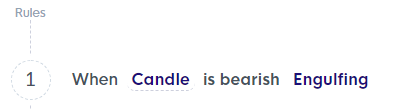

Candlestick patterns

Candlesticks and patters work very similarly, with the syntax being [CANDLE/CANDLESTICK PATTERN] is [BULLISH/BEARISH] [CHOSEN CANDLESTICK/PATTERN]

Examples:

A bullish strategy that can pertain to any trading pair

A bearish strategy that can pertain to any trading pair

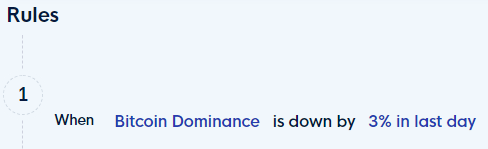

Crypto fundamentals

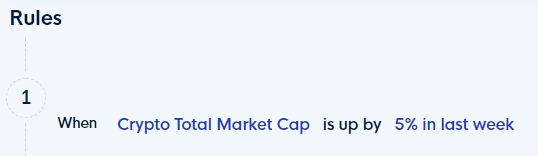

Examples:

When Bitcoin Dominance is going down you could choose to increase your altcoin holdings

A bullish strategy based on the total crypto market cap increasing

Putting it all together – trading rules to trading strategy

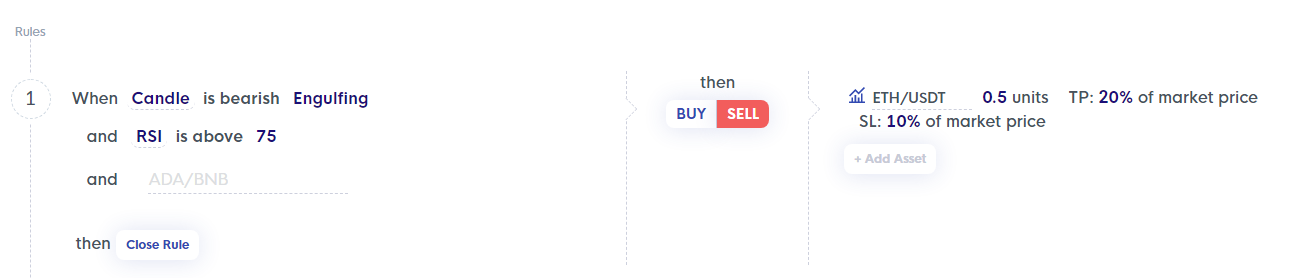

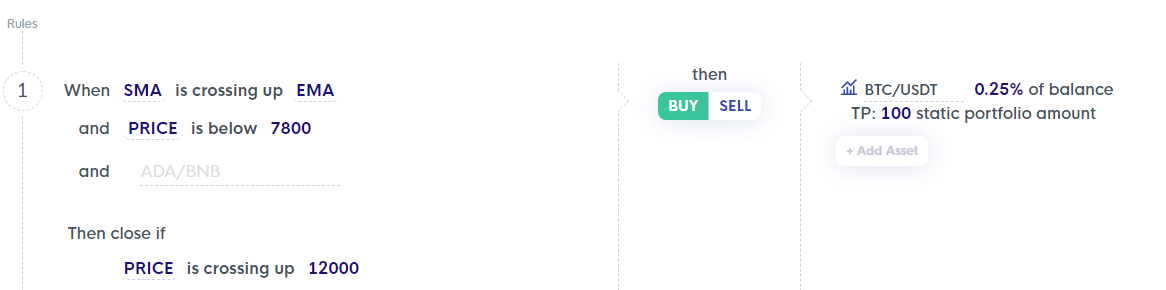

And finally, to demonstrate what a whole trading strategy/crypto bot would look like:

This is a shorting strategy for ETH/USDT waiting on a bearish engulfing and overbought RSI to happen at the same time.

This is a longing strategy for BTC/USDT. When the 9 period SMA (you can edit the period by clicking on the SMA after you set the rule) crosses the 20 period EMA while Bitcoin’s price is below 7800 USDT a purchase of BTC will happen. If price reaches 12000 the trade will be closed.

If you are interested in a more holistic overview of testing and creating a trading bot on CLEO.one check out this video:

Try your hand at creating a strategy and let us know what you think! We’re excited to see what you come up with!