A key benefit of creating a trading strategy with CLEO.one is the possibility to analyze your results. To do this well and be a great crypto trader you need to understand the difference between position, trade, and order. Our new portfolio pages lay it out for you. Yet on crypto exchanges these terms are often used interchangeably. In reality, each one has a very specific meaning and purpose.

You open a “long” position when you expect the price will increase. Or “short” when you want to profit from the price decreasing. You need to buy an asset and then sell it, hopefully ending in profit. The buying and selling will happen through trades: first exchanging USDT for BTC for example, and then selling that BTC for USDT again. Trades happen through orders on the exchange. So, positions are made of trades, and those trades are done through orders.

Orders in trading

Orders are requests for trading operations. Every time you want to place a trade on a crypto exchange you would do so by placing an order. We have two distinguishable categories of orders: market orders and pending orders. Market orders can be executed immediately, let’s say, BUY 10 BTC at the current market price. Pending orders are those orders, that wait for a certain condition to happen. Most frequently used pending orders are limit orders, which are a buy/sell of an asset but only when a specific price is reached.

Let’s consider an example where you are looking to enter a long ETH position with one of your strategies. It will be comprised of a Pending buy order until a condition is fulfilled. When a position is open your strategy will also place a sell stop loss order in case you have it.

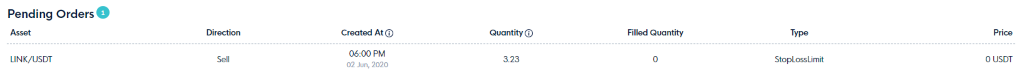

You can find pending orders that are waiting to be executed when their conditions are met. CLEO.one shows your pending orders under the Trades and Orders tab. You can find them on the Portfolio page:

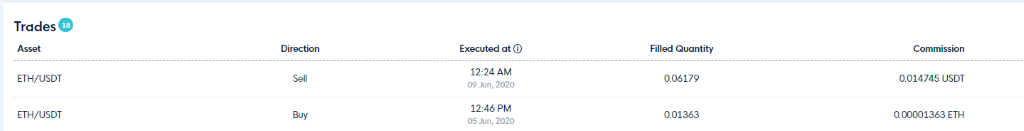

Executed orders are known as Trades and can be found under the corresponding tab.

Trades in trading

Trades happen as a result of the execution of the order to carry out a trade operation. Each trade is based on one specific order, while one order can generate multiple trades on the exchange – as if an order to purchase 10 ETH can be executed through several consecutive trades with partial execution. This happens as a result of variance in order sizes submitted by buyers and sellers – they do not match perfectly so you are buying form different sellers.

In this scenario, for example, a single 0.12372 ETH buy order was executed through 3 different trades on an exchange:

Positions in trading

A position is the amount of a security, commodity, or currency which is owned by an individual, dealer, institution, or other fiscal entity. Positions can be both long and short and formed as a result of purchases and sales. Position size may increase as a result of a new trade in the same direction.

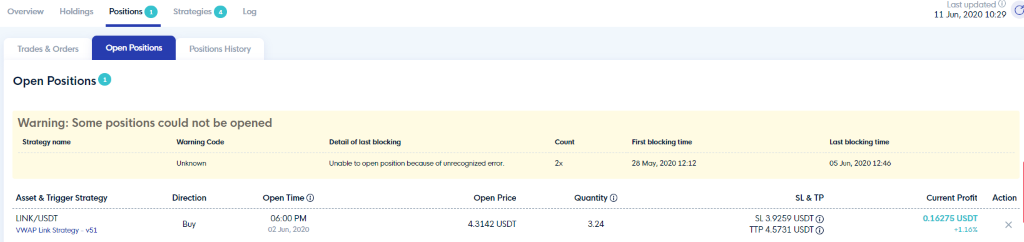

Positions are considered open, when the trade was made in one direction. It can either be BUY (longing) or SELL (shorting). Currently CLEO.one only supports BUY as an initial state. You can find a list of open positions in your portfolio under positions tab:

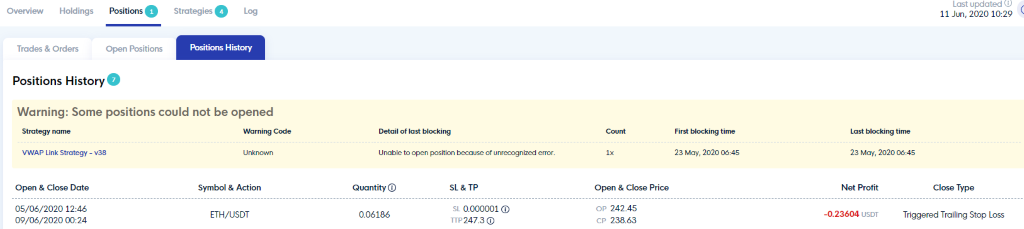

A long position is closed when the crypto asset is sold. Selling the asset is called closing a long position. Positions History can also be found under the positions tab:

If you see a great opportunity to enter a long position, check out our manual trades. You can enter positions with regular or trailing Stop Loss and Take Profit.