A few years ago, traditional financial instruments like payments, lending and borrowing were only available via banks and other established financial institutions. It all changed with the invention of blockchain technology and bitcoin. Since then developers and entrepreneurs have built a completely new system and we’ve witnessed the rise of CeFi (centralized finance), DeFi (decentralized finance), yield farming, and exciting opportunities for profits that came along.

** CoinMarketCap

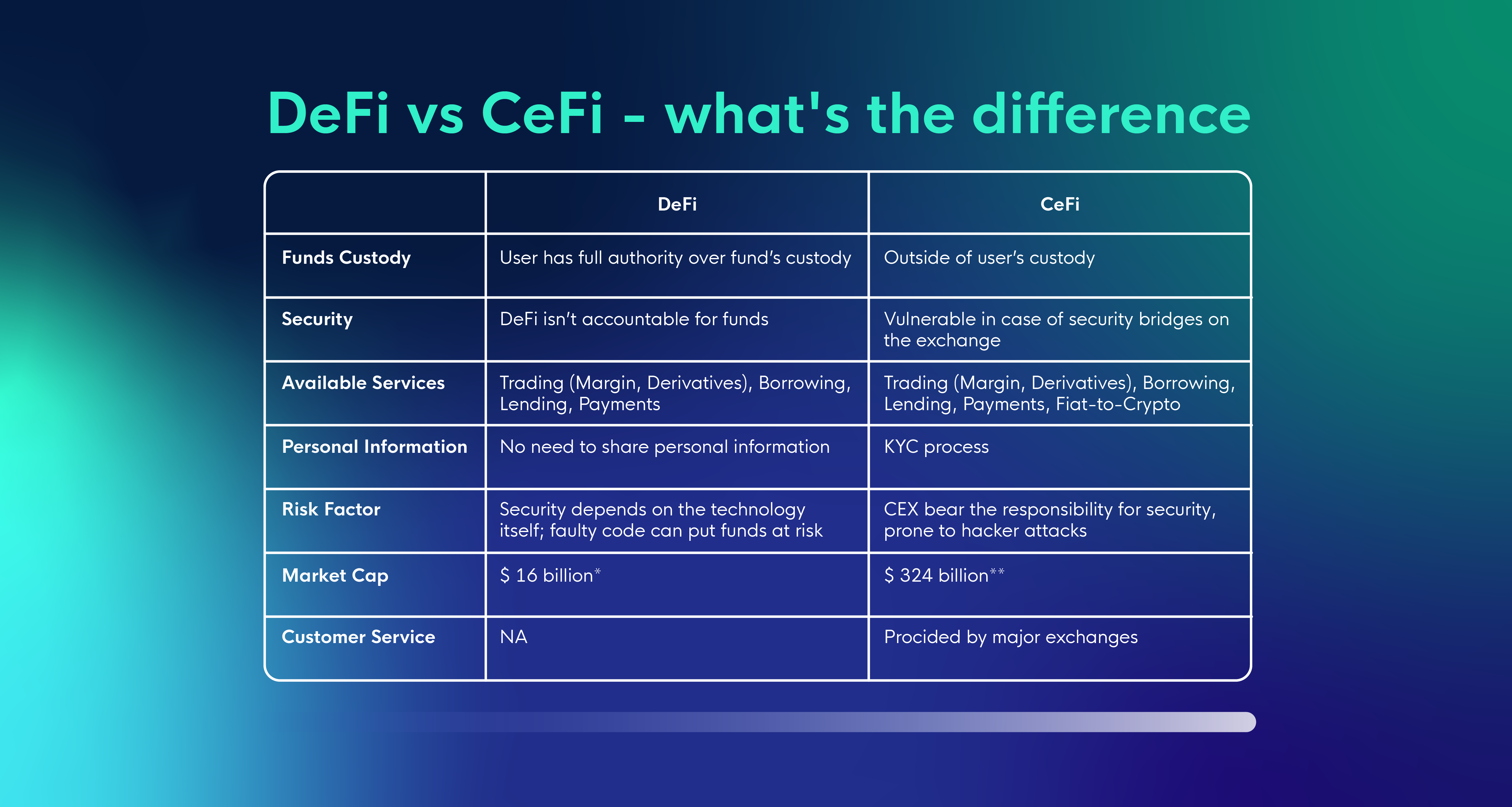

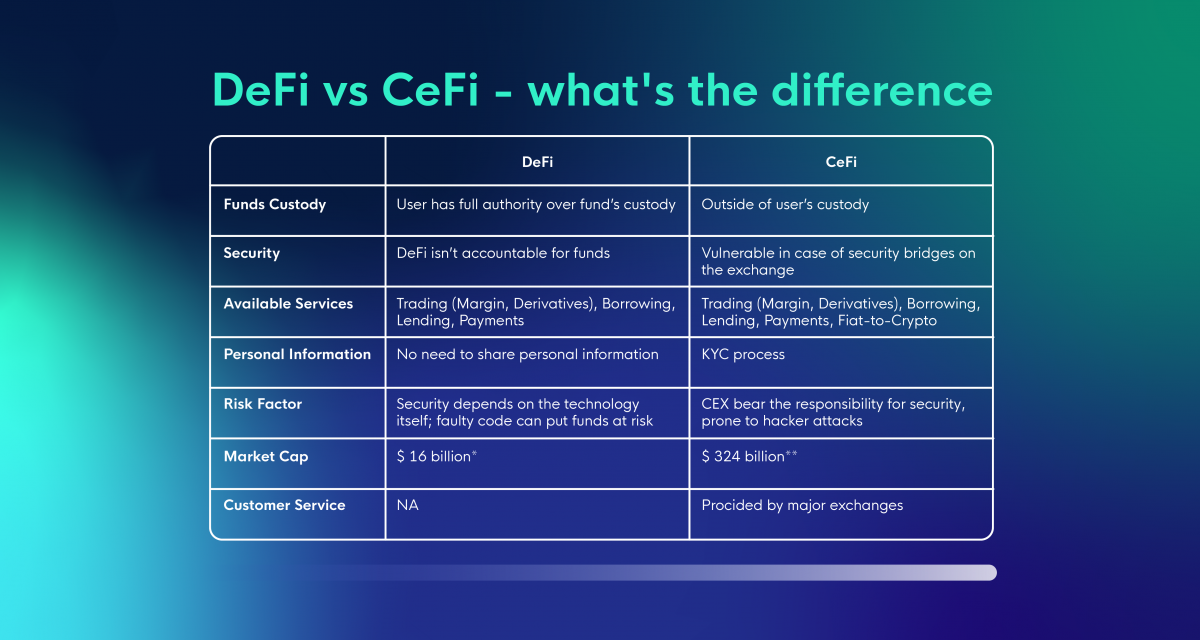

Defi & Cefi compared

We’ve already covered why you should be watching DeFi and how to use it to your advantage. This time around let’s compare it to the more familiar CeFi and the future of each. While both pursue the same idea of making financial instruments affordable, the ways they achieve this goal differ substantially. The table below summarizes the differences and similarities:

Defi & Cefi and custody of funds

DeFi eliminates the involvement of intermediaries, replaced by smart contracts. Smart contracts are self-executing transactions between a buyer and a seller. This way DeFi provides access to financial services without government and regulatory control. It makes it a viable option for users who do not have access to banking services under current systems. It also creates challenges that are not foreign to any new technology – trust and vulnerability, especially when it comes to funds custody.

As we’ve mentioned in the previous article, DeFi is built on the Ethereum protocol and mostly relies on the Ethereum chain. Most frequently traded coins exist on other blockchains than Ethereum. Since CEX (central exchanges) take custody of funds from multiple chains they offer a broader range of services based on different chains and more liquidity. On the other hand, overseeing custody of funds has made exchanges more vulnerable to numerous hacker attacks.

In essence, custody of funds is what differentiates CeFi from Defi. Centralized exchanges take care of your funds and store them for you. Decentralization and funds custody are a whole new game where custody stays with users but also depends on the code. With no regulators available in DeFi it is a big advantage aligned with the ethos of cryptocurrencies. Yet it can also become a huge risk in case of a faulty code or a bug, or malicious actors.

Choosing between Defi & Cefi as a customer

You might be interested in using some of these products for their financial services. Whenever you’re choosing between DeFi and CeFi, the question really is whether to trust people or trust technology. DeFi advocates believe that financial self-custody is enough to grow the space, others claim that self-regulation is a better way forward. Some projects even introduce admin keys for that purpose:

When compared to CeFi, DeFi still has a long way to go as it is constantly evolving and many new DeFi projects have huge potential. As with many exciting opportunities in crypto, it’s worth considering diversification.

Choosing between Defi & Cefi as a trader

As a trader you might be asking yourself one of these two questions:

Should you trade DeFi projects?

By all means, if the chart matches your strategy or you see a great opportunity – please do! In fact, you might already be trading them if you’ve dabbled in LINK, YFI or COMP. These projects are not featured only on DEXs but are available on some of the biggest exchanges like Binance and Coinbase. You don’t have to leave the exchange you are using if you like it to trade DeFi projects.

Should you trade on a CEX (centralized exchange) or DEX (decentralized exchanges)

This depends on your risk tolerance. DEXs feature tiny, unproven projects that might be a big boom or bust. Uniswap is famous for its open listing policy. Exuberance can drive projects to grandiose evaluations, only to have traders watch the price tank. Plus, the security risks and exit scams that can leave traders with nothing, quickly.

You need to know what you are doing with DEXs. Skyrocketing gas fees might make precise trading on a DEX extremely expensive.

Approach the DeFi vs CeFi chasm safely as a trader

If you choose a CEX make sure you do a few trial trades to understand how things work. Be ready for lower liquidity that might impair the precision of your trading. Finally set plenty of funds aside for gas fees.

If you choose to keep your funds on more familiar territory, you can use major exchanges to trade emerging projects using DEXs as a thermometer on which projects to research. This may protect you from rug pulls and other unwanted events by using some automation like CLEO.one to sell your funds if a project is tanking and you’re not trading at the moment.

Same thing about seizing opportunities. If a project is seeing a monstrous rise in volume you might want to be able to step in. A trailing take profit might be a nice touch on these projects if they are entering price discovery.

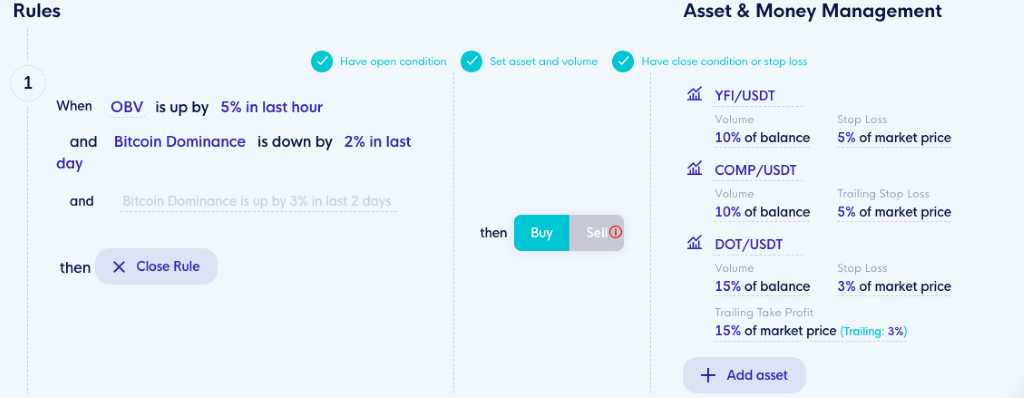

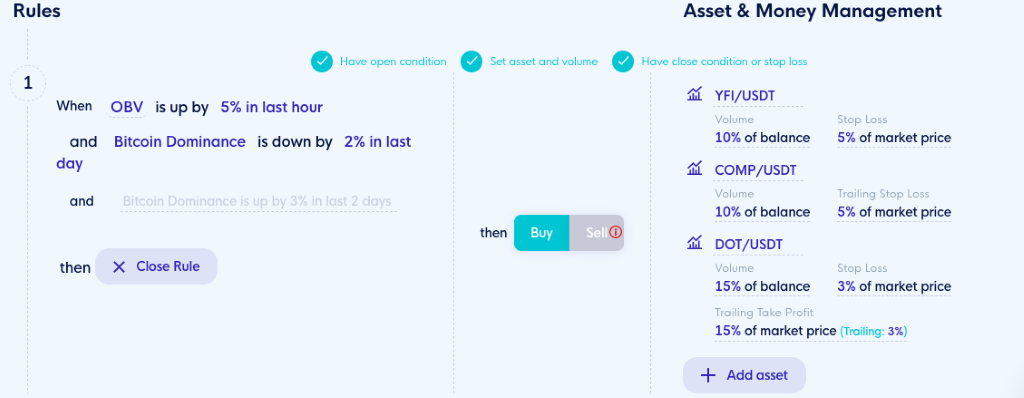

This is where setting a strategy to run as a bot on CLEO.one can be very fruitful. Of course, this also allows you to manage your risk through regular or trailing stop loss and take profit. Set a strategy to run on multiple projects so you don’t have to stare at charts and make sure you are active whenever the market is brewing:

This way you get to capitalize on the booms, without exposing yourself to the busts.

On more guidance on how to design great crypto trading strategies check out our suggestions in this guide on what to look for and how to create a somewhat safe strategy.

When you connect a Binance exchange account you can use CLEO.one for free! The account is packed with live trading bots, backtests, paper trading slots, and more! Sign up today and secure your spot.