Before we get started it is important to clarify one thing: yes, there are a lot of crypto bots out there and not all are worth your time or money. Finding the best crypto bot can seem daunting at first. They can be shady, cause losses, and just plain be untransparent about how they actually work.

Instead of pushing traders to rely on third-party bots and signals, we want to demystify how automated crypto trading works. Our goal is to help independent traders get the knowledge and tools to create their own crypto trading bots, based on great strategies.

In other words, this article will not teach you where to get the best signals or which whale chat to join. We also don’t believe that arbitrage is a safe strategy for crypto bot creation in terms of long-term profitability.

We won’t explain how to code your bot or where to get a reliable open source bot. You’d ideally not waste a minute on coding. Finding the time to trade can be hard enough.

At least 80% of the stock market is already automated, with that percentage belonging to high frequency trading, a subdivision of algorithmic trading. There is no doubt crypto will catch up soon enough. Using a well-crafted crypto bot is one of the least stressful ways to profit from the cryptocurrency market. There are lots of reasons: from 24/7 markets, to availability of data to trade with, and needing to have your emotions in check.

How to pick the best crypto trading bot platform in 8 steps:

If you have decided to give automation a try you need to look deeper into what kind of strategy will underline your bot’s trading behavior, how to test it and what to look out for. It is not about “cracking a code”, but rather about understanding how trading automation functions and ensuring all elements of risk management are in place.

Here’s how you do it:

1. Familiarize yourself with trading algorithms

Trading automation is based on pre-defined rules for position entry and exit or an algorithm. Since crypto trading bots are just active algorithms it is key to actually look into your entry and exit conditions.

To give a simple example, a trading bot can buy an altcoin once the price hits $1 or lower and sells once it hits $2. Any trading bot is only as good as the algorithm and strategy behind it. If you want to win, you need to know exactly what goes into it so you can improve on your results.

Get a bot that is fully transparent about the algorithm behind it, or, ideally, create your own. Until you feel confident that you understand the bot, avoid trading it.

2. Define your strategy

To create a bot you need a strategy first – if you fail to plan, you plan to fail. It’s not as easy as it seems to define a strategy that is constantly profitable. It has to follow the basic principles of a successful trading strategy. Following our guide will take you through the most challenging steps, eliminating unnecessary pressure.

If you are interested in creating a bot yourself – the good news is you don’t have to start from scratch, learn to code or perform advance calculations. There are great tools available for that – you can try CLEO.one as it also has the fastest backtester in crypto. And the best available way to determine your algorithm’s performance is to test is beforehand, which leads us to the next step.

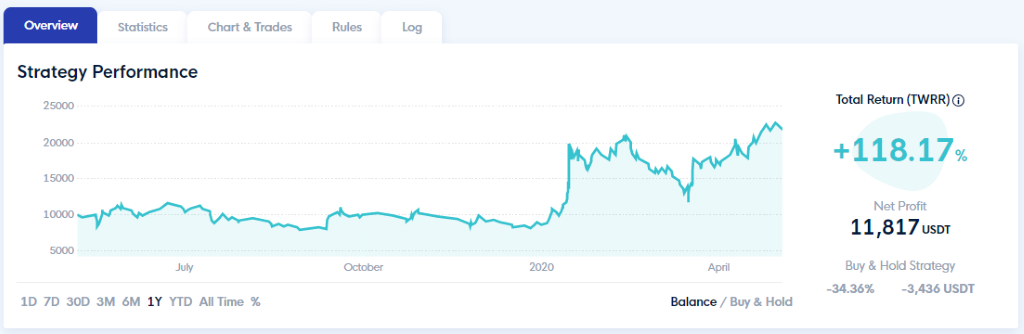

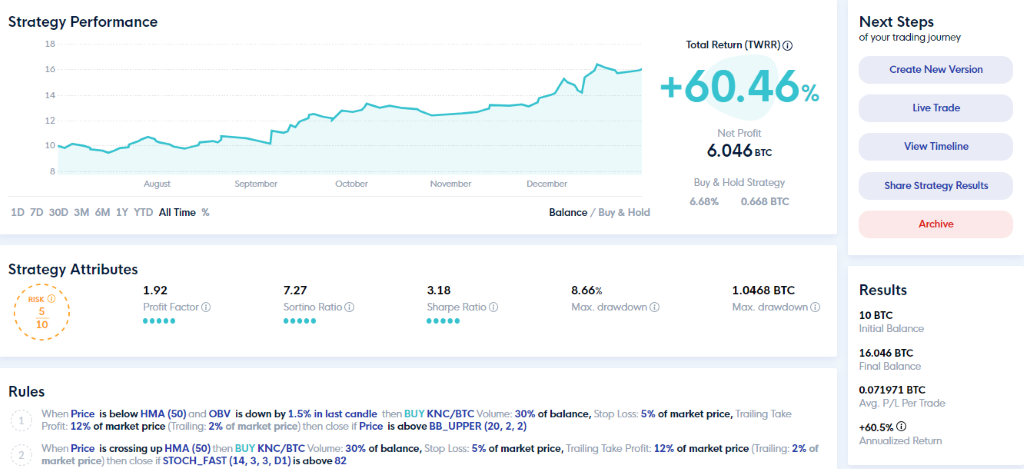

3. Put your bot to backtest

Backtesting allows you to test your trading strategies using historical data. Running a bot without backtesting is like buying a car without a test drive. While there’s no guarantee that a strategy that has worked in the past will also be as profitable in the future, it’s the best predictor of the strategies’ future performance available. Backtesting shows whether it’s worth launching your bot in the first place or there is more work to be done.

4. Check which indicators are available for your bot

If you are serious about crypto trading and want to do it actively it would be tough to get around without any technical analysis. You want to be looking at bots that provide variety of technical indicators for your future strategy, not just the basic ones. Developing an understanding of cryptocurrency technical analysis is key in bot creation.

Features like BTC dominance, candlestick patterns, correlations to other assets can be a very interesting way to construct your trading strategy. Technical indicators should of course be included in whichever platform you choose.

5. Only trust bots with solid risk management functionality

When choosing a bot pay close attention to risk management capabilities it offers. What are the options for placing a stop loss/take profit order? Can you set them as trailing? Can you select multiple conditions reflecting the market situation for a bot to close a position? Flexibility is key when it comes to minimizing losses.

6. Start small and build up

If you are new to using crypto bots, you should take your time to practice so it is recommended to start trading small amounts. Do not risk your whole balance. You can learn this by wiping out your whole account, but we’d rather not have you experience that.

Tools with helpful features for adjusting trading amounts come in handy. In CLEO.one you can set a trading amount in percentages of your current or initial balance, fixed amount or amount in traded currency. This can assure you, that you are risking just 1% per trade for example, while keeping 99% of your funds safe.

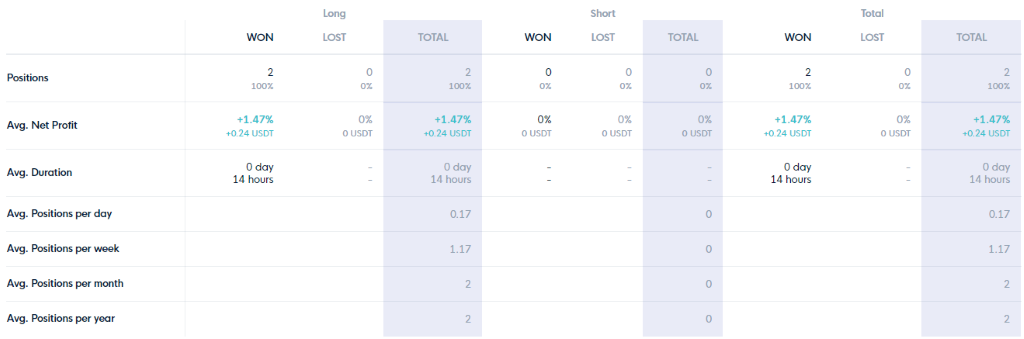

7. Search for the best way track of your trades

You’re going to need analytics and portfolio management tools if you want to stay on top of your trading bots. Not only analytical data, but also its quality plays an important role. For example, when measuring returns you need to have an apple to apple comparison between your bots with different metrics for measuring returns being displayed. You also want your analytics to be clear and transparent so that you can ensure the bot performs as it should.

8. Ensure you get the support you need

Nothing can elevate your experience as much as thought leadership that comes along with customer support. We’re not even going to mention speed and availability, we’re sure you know that it truly makes a difference between a great experience and a horrible one.

Check in with the customer support team and see if they are responsive and knowledgeable. Ask for a call if something is not clear to see if they meet your needs. If the product and team fit your criteria, you have found your platform.

For the best trading tool that will help you manage trading psychology with testing, automation, paper trading, and powerful risk management check out CLEO.one.

When you connect a Binance exchange account you can use CLEO.one for free! The account is packed with live trading bots, backtests, paper trading slots, and more. Sign up today and secure your spot.