You’ve seen the expensive car with “BTCMOON” license plates. You’ve caught the headlines about people turning into millionaires overnight by trading cryptocurrencies. You are starting to trade crypto! Your exchange accounts are set up, you have your starting funds ready, and you’ve been studying the basics of trading for months now.

For every highly publicized crypto trading success story, there are plenty that did not go so well, or in some cases left the aspiring traders financially ruined. Beyond the extreme cases there is everyone else.

Crypto trading, or any trading really, is about maximizing opportunities and minimizing losses. Here is the CLEO.one list of 10 things that every new trader should be aware of so they can do well. Odds are many of these will become important to new traders only after a few negative experiences. That’s how most of us learned unfortunately.

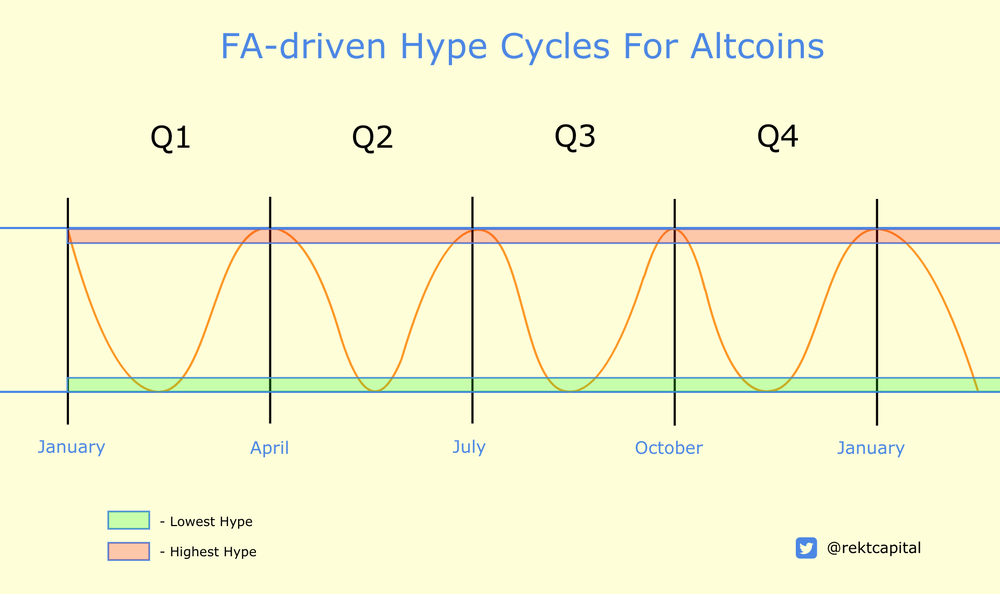

1. Cryptocurrencies move in cycles

Timing can be everything when it comes to altcoins. Traders first accumulate, then the hype sets in. Finally doubt pushes price down. If you had the choice you should be in an altcoin in the accumulation stage or at the begging of the hype. You can see some great examples of how these altcoin cycles work here.

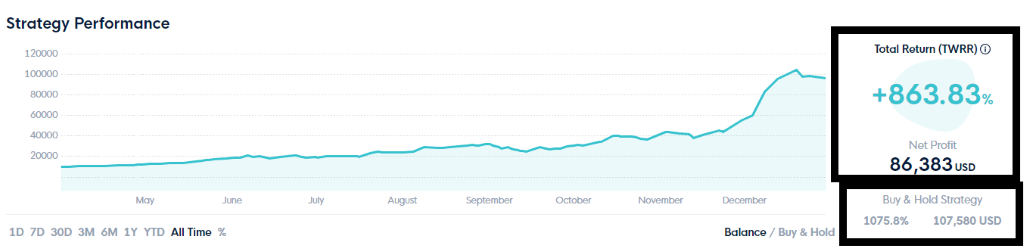

2. If you are not beating Bitcoin, you should consider just holding it

Trading takes a lot of effort and not a lot of us can do it as a full-time job. That effort must pay off. The same way stock traders check their performance against the S&P (index of 500 large companies), crypto traders check their performance against Bitcoin. If the return of all your trading activity does not beat what Bitcoin is doing, it is not worth to be trading. Just buy Bitcoin and hold it.

This is why you should evaluate the performance of any trading strategy against the god ol’ buy & hold. Even if it performs well it must beat doing nothing.

3. Don’t use your main personal email for exchanges

Exchanges have been hacked many times since Bitcoin’s conception. Not to mention human error like when Bitmex leaked 30,000 user emails in 2019 by disclosing them in the “to” field of one of their email updates. Your personal information is vulnerable, and your main email address is the key of it. Please for the love of Satoshi, open an email to use just for crypto trading.

4. Relying on other traders or Twitter accounts on when to buy/sell means you’re doing it late

Twitter features plenty of crypto trading influencers that muster followings in the hundreds of thousands. They may appear helpful and full of information. They also induce FOMO like no one else. If they start speaking about opening positions or closing it, sharing screenshots they are sharing this information only after it’s been done. If you and others take the same position it will sustain the trend, at least for a little bit.

It can take the mental fortitude of a stoic to hold yourself from jumping into a position when the tweet reads “Up 20% and waiting on the next +70” with 5634 comments agreeing. It truly is best to be patient. Look at the chart, plan a possible entry, but do not just click market-buy. You’ll end up with a bag of some altcoin you never wanted to hold.

5. Stop Loss/Take Profits will save you time and time again

When it comes to advice that new crypto traders ignore until it burns them, setting a stop loss and take profit would probably take the gold. You’d be hard pressed to find a career forex or stock trader that trades without them. Decades long experience has revealed the lesson: losses pile up and you need to be thinking about how much you are willing to lose on a single trade.

Crypto traders have been working with inferior tools. You can either set a stop loss or a take profit on most exchanges and when the market is going up it’s clear which one gets prioritized. It takes one sharp pull back to remind what kind of security and peace of mind setting both can offer. You don’t have to babysit every trade. Platforms like CLEO.one offer the ability to set both on a single position or a running strategy. Want to maximize profits? Go with trailing.

This exercise will help you polish up your entries and exits and get you that good night’s sleep that experienced traders cherish dearly.

6. Pullbacks are inevitable – make a plan

Crypto goes up, crypto goes down. Don’t stare at minute charts, zoom out to see the big picture, right? Well that’s true but your feelings have a long way to go before they can watch your stack drop by 50% in day (looking at you SXP). Your investment funds are one thing, but you need a plan on how low you can go when a trade goes against you.

Draw you supports and resistances in advance and include BTC even if you are not trading it. Your positions should be planned. You should know your stop loss, or what kind of loss you are exposing yourself to on each position. In case Bitcoin starts to plummet and takes everything down with it you will thank yourself for getting out in time. Then consider if BTC will bounce back first or that asset you were trading? Making these decisions as red is flashing on your screen, and price is tanking rapidly is very stressful and takes nerves of steel. Make that plan. This relates to the next point.

7. Leverage is one hell of a drug

The first phase of any bull run is exhilarating! Everything is going up and everyone is making money! On top of that now we have leverage so those gains can be x5, x10, x500. Did I mention everything is just going up?

So, you double down on your leveraged position and go about your day. Until you casually open Twitter to see traders in shambles that price was aiming for that next resistance and then tanked by 10%. Twitter is screaming about the Darth Maul candle. You try to remember if you used cross or isolated margin while you load account and… you get that liquidation email.

If none of this sounds familiar, congrats! You must be one of the traders that realized that with assets that move by more than 20% in a day can get you liquidated at as little as x5 and even Binance’s default setting is x20.

It’s understandable that leverage is attractive to traders especially as the market is going up. Do remember to use your Stop Loss. The great Bertrand Russel wrote in 1912 about a chicken being fed by a farmer every day, having a great life. The chicken starts to think that that is the law – all is good, and people are nice. Nothing about the chicken’s experience points to the fact that it will be slaughtered. Until it is.

8. Avoid buying at an All Time High

There is such a thing as a “hot” cryptocurrency. In 2020 it has to be Link with its parabolic run from below $2 to just shy of $20 within 5 months. When it starts to run it is tough to sit on the sidelines. However, when you look at the chart it’s visible that after every new ATH there was a pullback. At $4.5, a small one at $8 and now at $19.

It really does seem that once price starts to run it will never stop, but it always does. Remember there is still that person that bought bitcoin for $20,000. When an ATH is surpassed and the cryptocurrency is in price discovery let it run. After it cools off a bit – then consider if the upside is worth it.

9. Profits don’t matter until they are on your account

Exchanges have trading fees and withdrawal fees. The fiat gateways have trading fees and withdrawal fees too. Then there are taxes. What you see in your app as profit will be reduced by all these payments.

Secondly do you have a plan? Did you research fiat gateways with the smallest fees for your location? Or you will reinvest everything indefinitely?

10. Taking profits makes it worth it

Having a successful streak in crypto trading makes you feel like you have finally arrived! Couple it with a bullish market, watching your funds skyrocket and the only regret you feel is not buying more. That bag that made a x3 over 1 month? Not selling on coin till it’s x10!

Then out of nowhere the market turns direction with a violent speed. If you are running tested crypto bots, you will feel much safer. However, if you are trading in an alt as a base currency you will see your gains dwindle very rapidly.

All your effort will be worth it only when that money is out of your trading account. Take gains. Save them or buy things you like. Come up with a system: from every $500 you make, reinvest 50%. The rest goes in your bank account. Otherwise you risk wondering why you spend all that time working on something that brought you nothing.

Of course, there are many more things that we want to share but including them all in this article have a potential of turning it into a 3-hour read. We had to learn some of these lessons the hard way and you might too.

If you want to trade intelligently, think about your strategy. On more guidance on how to design great trading strategies check out our suggestions in this guide on what to look for and how to create a somewhat safe strategy.

Backtesting is a great way to see how trading approaches, different stop loss and take profit levels, or trading vs holding would have performed. In CLEO.one you can create strategies in minutes and test them on historical data. You can then automate them as crypto bots for precise, 24/7 execution.

Now, when you connect a Binance exchange account you can use CLEO.one for free! The account is packed with live trading bots, backtests, paper trading slots, and more! Sign up today and secure your spot.