If you are new to crypto trading there’s plenty to overwhelm you: the slang, mastering the basics of trading, charts, volatility, influencers predicting the moon or doom, and the technology – to name a few. Every day seems like it’s the last day “we are seeing these prices,” or “last day before moon.” Everyone seems to have mysteriously gained experience while you are grappling with the basics. You feel pressured to take some position, any position, and to do it now.

Don’t worry, you have merely entered the world of crypto where everyone is seemingly either picking a colour for their Lambo or declaring financial ruin. Your edge, your advantage lies in being smarter, more methodological than the wisdom of the masses conventionally allows.

No one reaches long-term trading profitability through rash decisions – they make rash decisions because of a lack of a plan.

There’s great technology and data available today that will make you a confident crypto trader and you can do it faster than the majority. Entering the space today means you can learn how to avoid making the mistakes of your predecessors. We’re laying out 3 things you can do today to master the basics of crypto trading and gain confidence.

1.Start thinking in terms of trading strategies

You will see a lot of info on social media about what a certain indicator is showing, but rarely do crypto traders share their full strategies. This makes perfect sense since a solid strategy is what makes a trader.

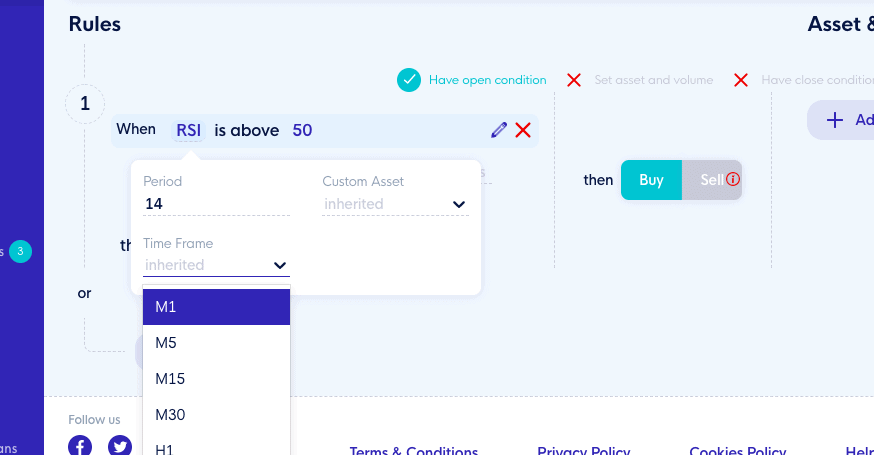

Instead of chasing different indicators start thinking in terms of strategies: “if I bought when X happened and sold when Y happened” what would the result be? Pull up a TradingView chart with your favourite crypto project and start noticing which indicators react at key moments when price goes up or down.

Start with the basics, you can find a library of crypto trading strategies here. The next step is taking a crack at designing your own. You can start with this guide.

2.Put the experts to the test

You don’t have to work on this in isolation. As mentioned before plenty of traders share their ideas on TradingView, Twitter and Bitcointalk. Maybe you found someone you really like and have been following for a while. If they are a solid trader, they mention what they are basing their decisions on.

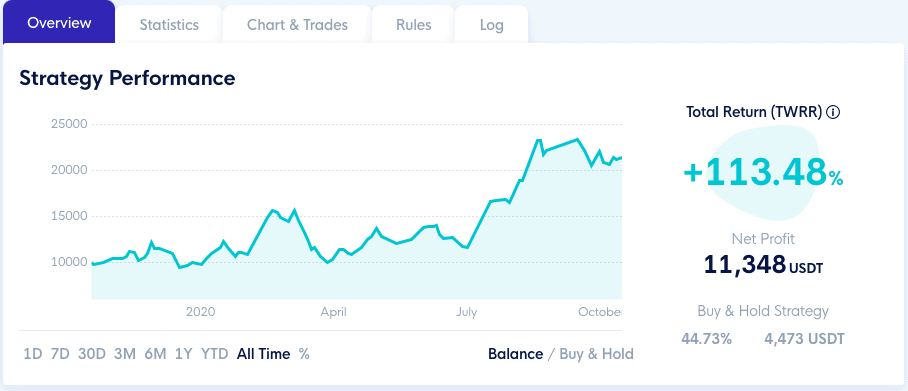

The good news is that you do not have to guess their success rate, you can see for yourself. Backtesting a crypto strategy is running a strategy on historical data so you can see how it would have performed. Crypto is still such a nascent market, where overwhelming majority of crypto traders still do not do this.

Take a strategy that you’ve discovered through step 1, or one someone mentioned and test it. You can do it for free in minutes, without programming in CLEO.one.

This is a very important sobering step. You will quickly discover that what is popular is not necessarily great. What’s better once you add some of your own input you might eventually get to a better version. This gives you confidence.

For example, we tested some of the most popular strategies during the crypto bull run of 2017. The results are enlightening, and you can also find examples on how to improve trading strategies from their first draft.

3.Start piloting your trading ideas risk free

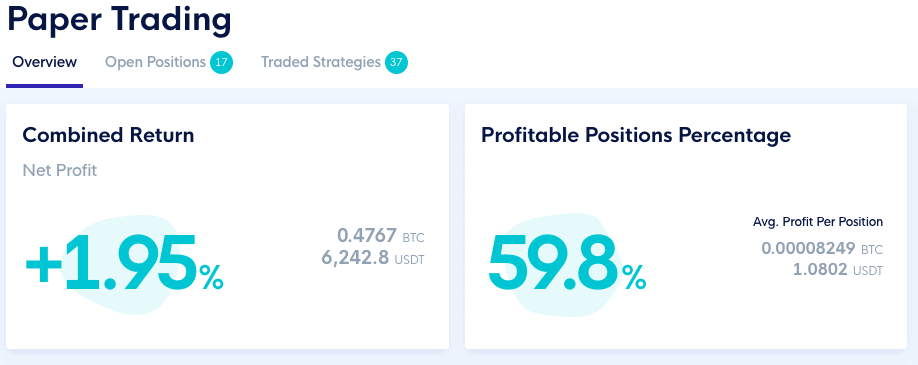

When you’re starting off, you’re itching to get to trading to get the immediate gratification in form of seeing green dollars bounce up on your account. But chances are you will not do very good right from the get-go. Luckily you can get to trading immediately without risking any of your funds until you have something you want to pilot. Paper trading is demoing trading strategies as crypto bots or placing manual positions with virtual money. It is a must-have tool for polishing ideas in legacy markets. It could be that the low barrier to entry in crypto pushes novices to skip this step.

All it takes is for you to set a few strategies or start placing trades as you normally would and investigate your results to identify your best trading ideas. Once you see there’s a strategy that stands out start executing on the exchange or set it as a crypto bot with some modest funds. That way you’re learning trading while protecting your funds until you have something solid.

Trading is a craft on its own and crypto trading has additional challenges. If you want to master the basics, and start working towards long-term profitability, and eventually financial freedom these 3 steps will help you get there. Within days you can start thinking in terms of strategies, test out a few candidates and have results based on real market data. This will give you an edge and a solid base to build on.

You can complete all steps in CLEO.one for free when connecting a Binance account. Feel free to use some other platform as well although it may cost you plenty of time and money. Best of luck.